An unusual error hindered your QuickBooks update? Well, while updating your QuickBooks payroll software, you might land on the most common QuickBooks errors i.e. QuickBooks Error PS077 and PS032. These Payroll errors often show up when users try to download updates of QuickBooks Payroll. If you too come across this error while downloading the payroll updates, here is everything you should know about the QuickBooks Error PS077 and PS032.

However, for any further information or if you are seeking expert assistance, then the user can feel free to call us at our toll-free number i.e. +1-888-510-9198. Our QuickBooks error support team will help the users in getting rid of the QuickBooks payroll error PS077 or PS032.

You may also read: How to resolve the QuickBooks error 6209?

Brief into QuickBooks Errors PS077 or PS032

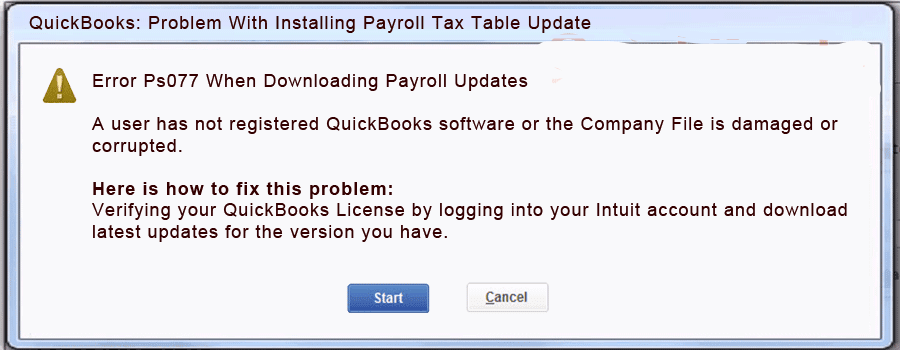

Before you learn the causes and fixes of the QuickBooks error PS077 or PS032, it is important to learn about these errors. This error code is often seen when the user tries to download payroll updates. It comes up with an error message stating:

| Payroll Update | [PS032] QuickBooks can not read your payroll setup files, Note the message number at the beginning of this message, and click Help for troubleshooting tips to resolve this problem. |

| QuickBooks: Problem having trouble installation payroll tax table update. | Error PS077 When Downloading Payroll Updates A user has not registered QuickBooks software or the Company file is damaged or corrupted. |

It should be noted that the prefix PS indicates a QuickBooks payroll error. These errors can hamper the progress of QuickBooks activities. As a result of such an error, the tax table might fail to update or might get stuck in the middle of the process. It can further lead to freezing your system. There can be various factors causing this issue, the user can check them out below.

What May Lead to QuickBooks Errors PS077 or PS032?

Here are a few factors causing QuickBooks payroll error PS077 or PS032:

- When QuickBooks failed to read the information registered for the software

- When your Billing Information may be incorrect

- QB Payroll or some of its components may have damaged tax table files

- Your billing information is outdated or incorrect

- QuickBooks Company files may be damaged or corrupted

- You might not have registered your QuickBooks software

Important Points to remember :

- The user will first have to validate the QuickBooks payroll subscription

- Also, the user is required to update QuickBooks desktop application with the latest released updates

- One more thing that the users should consider is to verify that the billing information entered in the payroll account is proper

- The user should also ensure to take a backup of the QuickBooks company file

- make sure to only have one QuickBooks applications installed on the system

Read Also: How to fix Reconcile Discrepancies in QuickBooks?

How to Solve QuickBooks Error PS077 or PS032?

You can follow the below-mentioned steps to fix these QuickBooks payroll errors PS077 or PS032:

(Note: You may not necessarily require completing all the provided troubleshooting steps.)

Solution 1: Repair QuickBooks

- First of all, Logout from your QuickBooks account

- After that close all your system windows, ensuring that no QuickBooks windows is left open

- Open Windows task manager and verify all opened QB windows

- Now, reopen QuickBooks and attempt to download the payroll updates once again

- If the issue is still unresolved, go to File and select Utilities and Repair QuickBooks

You may also read: How to Fix QuickBooks Error 6000 77?

Solution 2: Turn Off UAC

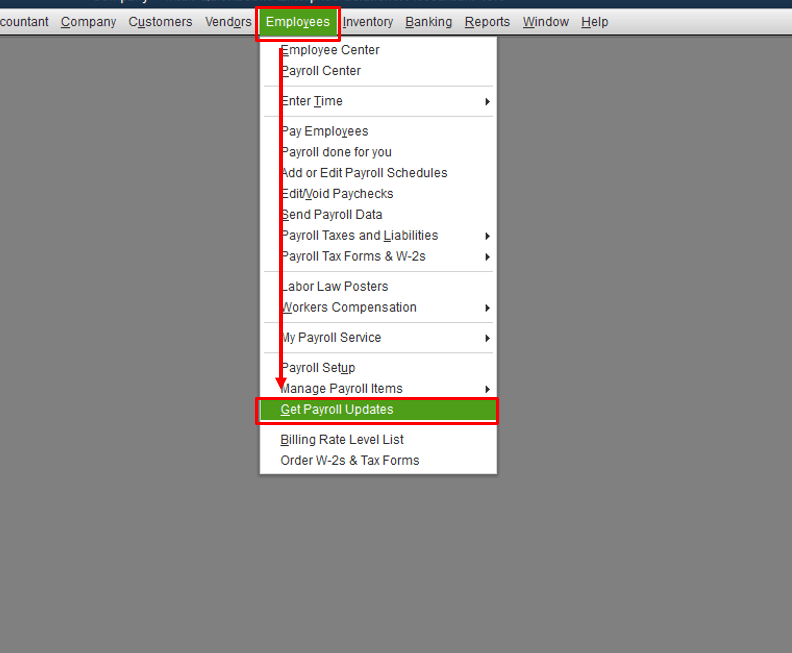

- Log in to your online Intuit account and verify your QuickBooks License, check if you have the most recent update for your QuickBooks version. (Note: Click here to check the product version & release of your QuickBooks)

- Check your details such as billing information dates on your QuickBooks Payroll service account information.

- Refer to QuickBooks error technical support team to fix your QuickBooks errors.

- Check and create your QuickBooks data by going to file and then utilities

- If you are using Microsoft Windows 7 or 8, you should switch off User Account Control (UAC) and try to download the QuickBooks Payroll updates

Condition 1: If One Version of QuickBooks Desktop Installed

If you have only one version of QuickBooks Desktop installed, no need to complete these steps.

- First, make a backup of your QuickBooks company file.

- Close all the applications, if open.

- Open the Run Window.

For Windows 8:

- First of all, go under the Window System section.

- Now open the Start screen

- After that right-click on the background to All Apps

- Now select the Run option.

For Windows 7 and XP:

- If you are not logged in with Admin rights just click Start

- After that click on All Programs

- Then click on Accessories

- And finally, click Run.

Windows Vista:

- Click on the Start button. In the start search field, enter the Run command.

Condition 2: If you have multiple versions of QuickBooks installed:

First of all, Install a clean version of QuickBooks desktop to perform well in Selective Startup.

- For multiple versions of QuickBooks Desktop:

- Remove all the additional installations.

- Reset your QuickBooks update.

- Download the latest payroll tax tables.

- Re-sort the lists, then use the Verify Data/Rebuild Data process. (Rebuild the Data only if necessary).

- Perform a clean Uninstall/Re-install in Selective Startup.

Solution 3: Change the CPS folder name

- Here, the user is required to open the file explorer by pressing Windows + E

- After that select the option stating This PC

- Once done with that, the user should head to the local disk C

- If you are unable to find the program files, then open the program files folder.

- Also, open the QuickBooks desktop folder that resembles your version of the software.

- The next step is to open the components and also go for payroll folder.

- And then, right-click on the CPS folder

- Now, go for the rename folder option.

- Also, rename it and also enter CPSOLD

- The user should then hit the enter tab.

- And make a new CPS folder and open QuickBooks desktop.

- Now, download the latest payroll tax table update

Solution 4: Rename QBWUSER.ini and EntitlementDataStore.ecml files

- Under this process, you are supposed to locate the QBWUSER.ini file on the system and further open it.

- Now, right-click the file once you have spotted it.

- The next step is to rename it.

- And further, add .old to the end of the existing name.

- You now have to rename the EntitlementDataStore.ecml.

- Later on, open QuickBooks software and access the company file.

- Form a duplicate copy of the file and save it to the computer’s local folder.

- Once done with that, move to the folder and open the file.

- The last step is to check if the file opens without any error.

Solution 5: Use QuickBooks Install Diagnostic tool using Tool Hub

- You need to download and set up QuickBooks tool hub on your system.

- Once done with that, launch the tool.

- Select Installation Issues tab.

- Now, select QuickBooks install diagnostic tool.

- This might take time, depending on the size of the company file.

- Wait for the tool to complete the diagnosis.

- Towards the end, restart the system and check if the issue is rectified.

Solution 6: Add a new user account

In case none of the above measures helped, you can try adding a new user account. The steps involved here are:

- To begin with, press Windows tab and go for the settings menu.

- Once done with that, select Add someone else to this PC in the Other Users tab.

- You will then have to select the option I don’t have this person’s sign-in information.

- After that choose Add a user without a Microsoft account.

- A name must be assigned to the new account.

- Later on, click on the finish tab.

- And also choose the account you have set up.

- You now have to select the account type and hit the admin tab.

- The next step is to click on the ok tab.

- Also, open QuickBooks and access the company file. This would fix the issue up to a certain extent.

Read Also: How to Fix QuickBooks Error 6129, 0?

Final Words!

We hope that the above-mentioned troubleshooting steps will fix the QuickBooks Error PS077 and PS032. If the issue still prevails, you can contact our experienced QuickBooks Payroll customer help team which is equipped with modern tools and technology to fix any QuickBooks-related issue.

Call us at +1-888-510-9198 early in the morning or late in the night, we are available round the clock.

More helpful articles to read:

How to Fix “Failed to send usage data” problem in QuickBooks?

How to resolve QuickBooks error 5502?

Steps to Fix QuickBooks Error 6000 304

Some Common FAQs related to QuickBooks Error PS077 and PS032:

QuickBooks Error PS077 or PS032 occurs when the software is unable to download the payroll updates. Error PS077 usually indicates a problem with the tax table update, while PS032 indicates an issue with the QuickBooks payroll subscription. These errors prevent you from downloading the latest payroll updates, which can lead to incorrect payroll calculations and other issues.

The common causes of QuickBooks Error PS077 or PS032 include:

1. Incorrect payroll subscription details or an expired subscription

2. Damaged or corrupt QuickBooks company file

3. Outdated or incorrect QuickBooks installation

4. Incorrect QuickBooks company file setup or configuration

5. Internet connectivity issues or firewall restrictions

Here are some troubleshooting steps to fix QuickBooks Error PS077 or PS032:

1. Check and renew your QuickBooks payroll subscription if it has expired

2. Verify that you have an active internet connection and that your firewall is not blocking QuickBooks

3. Update your QuickBooks to the latest release

4. Verify your QuickBooks company file and ensure it’s not damaged or corrupt

5. Perform a clean installation of QuickBooks and then reinstall the latest payroll updates

Yes, you can prevent QuickBooks Error PS077 or PS032 from occurring by:

1. Renewing your QuickBooks payroll subscription before it expires

2. Verifying your QuickBooks company file for errors regularly

3. Updating QuickBooks and the payroll tax table regularly

4. Ensuring that you have a stable internet connection and that your firewall is not blocking QuickBooks

5. Running regular virus scans to prevent damage to your QuickBooks company file.