Bad debts are the debts that become unrecoverable and are required to be written off, in order to avoid miscalculations in the end. The QuickBooks accounting software allows the users to write off bad debts in QuickBooks by performing some set of steps. To help you in writing off bad debts successfully, here we are with this segment sharing the steps to write off in detail. Note that, the steps for QuickBooks online users and QuickBooks desktop users differ.

Thus, to learn further about writing off bad debts, stick around this segment till the end. Or you can further give us a call at +1-888-510-9198, and discuss your queries with our technical support team. Having said that, let us check out the steps to write off bad debts in QuickBooks.

You may also see: How to Fix QuickBooks Crash Com Error?

What is the need to write off bad debts in QuickBooks?

Bad debts are basically recorded when the amount that was supposed to be received from the customer fails to be recovered. Businesses using QuickBooks can consider bad debts as invoices that become uncollectible over the course of time. Thus, writing off these bad debts makes it easy for the business to record the actual profit and the average net turnaround. Writing off bad debts manually might seem to be a tedious task, but QuickBooks makes it a lot easier.

Important Points to Note

Before we proceed with the process of writing off bad debt in Quickbooks Desktop, it is crucial to keep the following points in mind:

- Well, a user can write off bad debts as deductions.

- Another essential point to consider is that you can get acquainted with all the different types of bad debts and unpaid invoices upon creating a bad debt account.

- You can use QuickBooks to write off overpayments.

Steps to Write Off Bad Debts in QuickBooks

The user can try performing the below set of steps to successfully write off bad debts in QuickBooks.

Step 1: Creating a Bad Debts Expense Account

- At first, the user needs to open QuickBooks desktop and head to the settings tab

- Once done with that click on charts of accounts from the list of options

- The next step is to choose new to create a new account

- The user should then click on expense option from the account type dropdown

- Also, click on the bad debts option in the detail type drop-down

- Once done with that click on save and close tabs and you are done

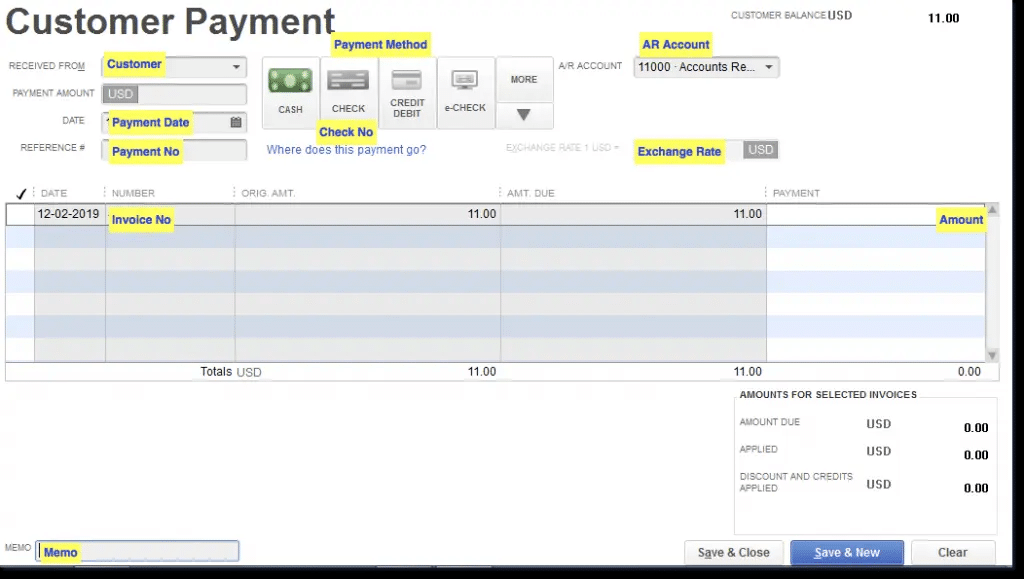

Step 2: Closing Out the Unpaid Invoices

- Under this step, the user is supposed to open Customers menu and go for Receive Payments

- Once done with that the user should enter in the customer’s name in the Received from field

- After that, in Payment amount space type in $0.00 and go for Discounts and credits.

- The next step is to enter in the value that is to be written off in the amount of Discount field

- After that, for Discount Account, choose the account you added in the previous step, and press Done.

- The next step is to select Save and Close.

Read Also: Versions of Windows 10 are Supported with QuickBooks Desktop?

Steps to Writing Off Bad Debts in QuickBooks Online

If you are a QuickBooks online user, then the steps below can help in write off a bad debt in QuickBooks successfully.

Step 1: Check ageing accounts receivable

- The user needs to first move to reports menu.

- After that search for and open accounts receivable ageing detail report.

- The user should then check which of the accounts receivable outstanding should be written off

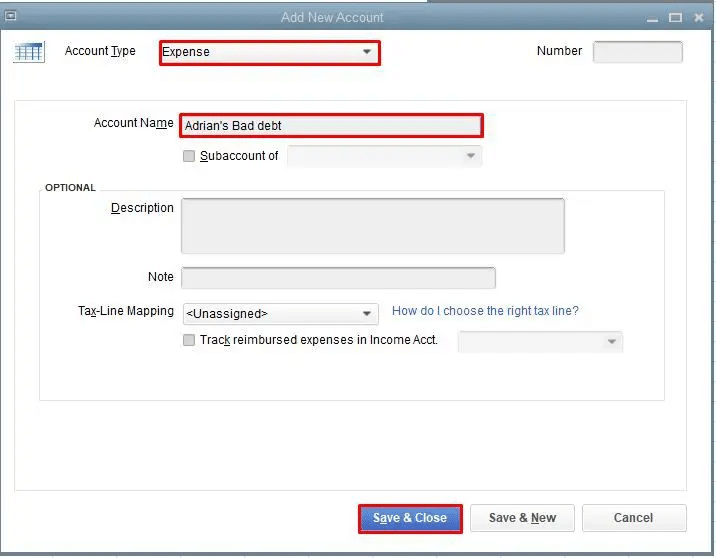

Step 2: Create a bad debts expense account

- Under this process, the user should head to settings option and also select chart of account.

- After that go for new to create a new account.

- And then from the account type dropdown, opt for expenses.

- The user should then select bad debts from the detail type dropdown

- Complete these set of steps by selecting save and close options.

Step 3: Creating a bad debt item

- Once done with that select new tab and choose non-QuickBooks inventory.

- Once done with that enter in bad debts in the name fields

- And also go for bad debts from the income account drop down

- The next step is to complete the process by selecting save and close tabs respectively.

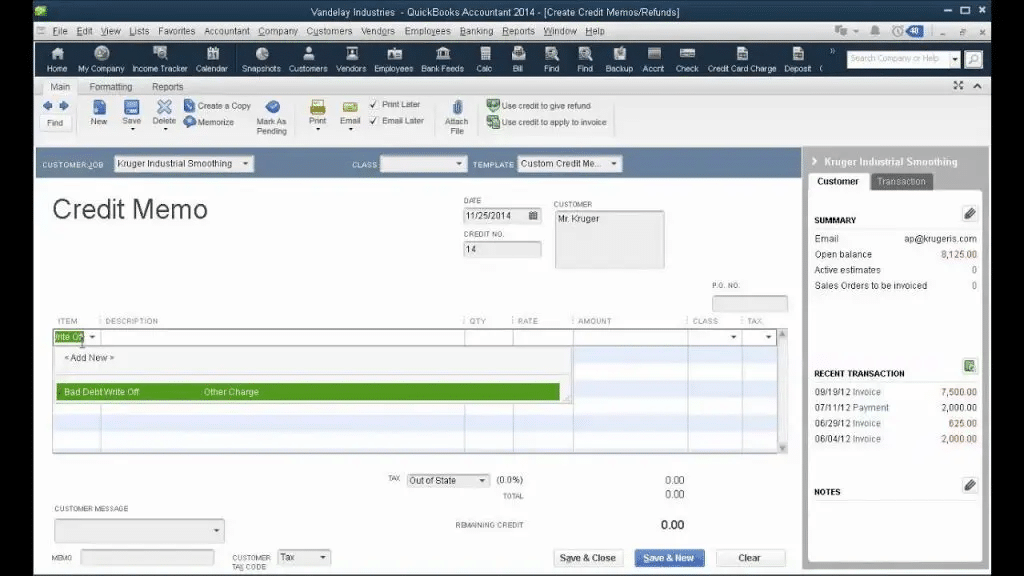

Step 4: Create a credit note for the bad debt

- The user is first required to select New.

- After that select credit note.

- Once done with that head to customer from the customer drop down.

- Now, in the product/service section, go for bad debts.

- The user will have to type in the amount to write off in the amount column.

- Enter bad debt.

- And select save and close tab.

Step 5: Apply the credit note to the invoice

- The first step is to select +New option.

- After that, under customers and choose receive payment.

- The user should then select the appropriate customer from the customer dropdown.

- And head to the QuickBooks invoices from the outstanding transactions section.

- Once done with that, from the credits section select the credit note.

- Click on save and close to complete these steps

Step 6: Run a bad debts report

- At first, the user should move to the settings option.

- And then head to chart of accounts.

- Once done with that, in the action column of the bad debts account, select run report.

- For this, the user should head to the sales menu and also go for customers.

- Once done with that select customer’s name.

- And also go for edit.

- After that, in the display name as field, type in bad debt or No credit after the customer’s name.

- And lastly click on save.

Also Check This Out: How to Enter and Delete Transactions by Batch in QuickBooks Desktop?

Steps to Write Off Invoices in QuickBooks Online Accountant

You can handle the invoices that you can’t collect with tools to how to write off an invoice in QuickBooks online. QuickBooks on its own applies discounts to zero-out bad invoices and further posts them to the write-off account. This balances both the accounts receivables and expense account. The clients can manually write off bad invoices too. Here is how to write off invoices in QuickBooks online.

- Move to the Accountant Tools and further choose Write off invoices

- The next step is to set the invoice age, to date, and balance less than filters.

- You now have to choose Find invoices.

- Also, review the name in the customer column.

- Choose the checkboxes for the invoices you want to write off.

- And also, go for the write off option.

- After that, in the account ▼ dropdown, you need to choose the account you use for bad debts.

- And also click on Apply tab.

Also, note that you do not need to enter your closing date password in case you are writing off invoices dated before your closing date. This is how do you write off an invoice in QuickBooks, hope this works for you.

Read Also: How to Fix Invoice Formatting Issues with QuickBooks?

Conclusion!

This drives us to the end of this article where we hope that the reader might be successfully able to write off bad debts in QuickBooks. If in case there is any query or if the user needs our assistance at any point of time, then getting in touch with our QuickBooks support team is all that we suggest. Give us a call at +1-888-510-9198, and let our experts handle the issue for you and help you in writing off bad debts successfully in QuickBooks.

FAQs Related to Write off Bad Debts in QuickBooks

How Do I write off an amount in QuickBooks Desktop?

You can write off an amount using the steps below:

1. From the vendors menu, choose pay bills

2. After that, pick the bill that has the balance that you need to write off.

3. Now, choose set discount.

4. Once done with that, choose discount tab and further enter the amount in the amount of discount field.

5. You now have to choose pay selected bills to close the pay bills windows.

6. Choose done in the payment summary window.

How do I write off in QuickBooks online?

Your clients can manually write off their bad invoices.

1. Move to the accountant tools and choose write-off invoices.

2. Set the invoice age, to date, and balance less than filters.

3. Select Find invoices.

4. Review the name in the customer column.

5. Choose the checkboxes for the invoices you want to write off.

6. The last step is to choose write-off.

How do you account for bad debt write off?

The direct write-off method usually takes place after the account receivable is recorded. You must further credit the accounts receivable and debit the bad debts to write it off.

Few other articles to read:

How to Sync QuickBooks Files Between Two Computers?