Learn the best ways to use the undeposited funds account to receive payments in QuickBooks Online (QBO)

No doubt, QuickBooks is the world’s best accounting and bookkeeping software made by Intuit. Talking about the undeposited funds account in QuickBooks online, it serves a special function, as it is a special temporary account that is used by the QuickBooks accounting software for holding the payments that are received from invoices before the user deposits them into the bank account. If you are one of the users who import payments data from external processing services, and do not process transactions via QuickBooks payments, then this workflow is essential for you.

In today’s article, we are going to discuss the use of the undeposited funds account, in order to receive payments in QuickBooks Online. Thus, if you are looking for the entire process to use the undeposited funds account to receive payments in QuickBooks online, then your search ends with our article.

Go through the article till the end, to learn the process. However, for expert assistance, you can make a call at our toll-free number i.e. +1-888-510-9198, and discuss your issue with our QuickBooks support team of experts and certified professionals.

Read Also: How to Fix QuickBooks Error Code 6150?

Significance of Undeposited Funds Account

As stated above, undeposited funds is an account in QuickBooks accounting software that holds funds from the payments until they are deposited in the bank account. As per the experts, the user can’t deposit the fund directly to undeposited funds. The reason behind this is that it is just a temporary account that means that the user can deposit the funds in a single transaction only after he/she takes the deposits to the respective bank account.

Making a lump sum payment is beneficial in a way that the transactions remain itemized in the account register, but all that user is supposed to do is to check the lump sum deposits when reconciling transactions with the statements of bank.

Reason behind using Undeposited Funds Account

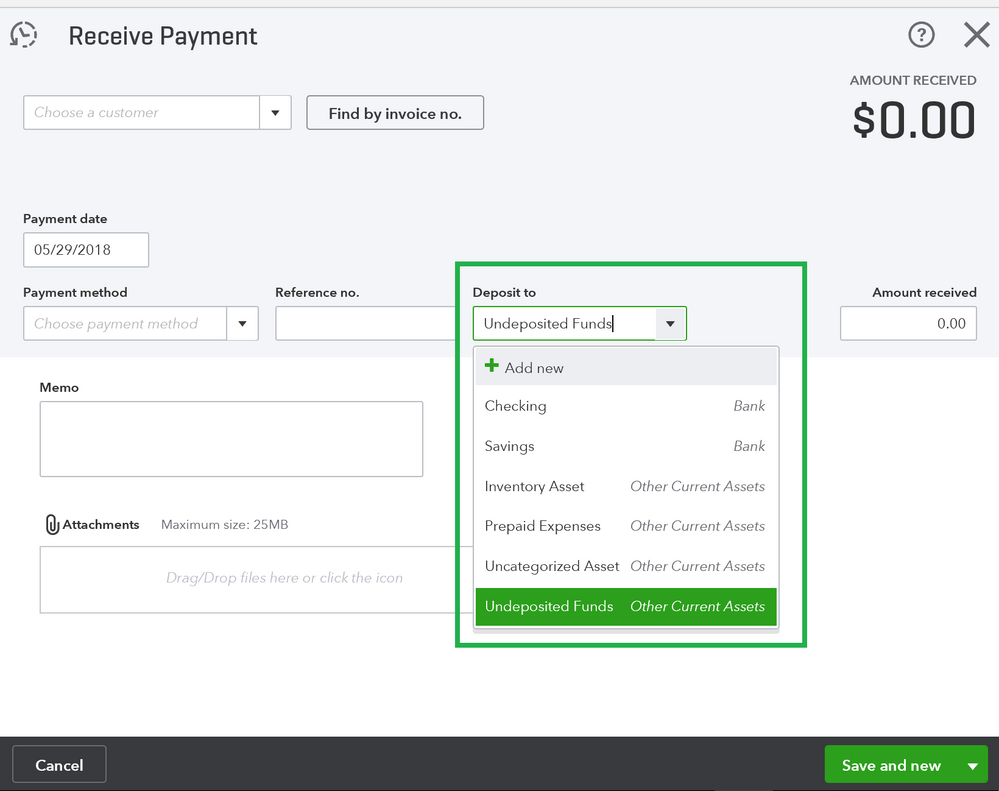

Many QuickBooks users ask this question very often that why they should make use of the undeposited funds account. The undeposited funds account is an internal “other current asset account” crafted by QuickBooks. For instance, if the Undeposited funds account is a lockbox or safe, where the user keeps the payments till the time, they are not deposited in the bank account. This account in actual serves as a default “deposit to” account and is designed in a way to work with the receive payments and bank deposit features, in order to complete the invoicing process. The user can make use of this account for single or group payments.

You may also read: How to convert your QuickBooks Desktop file to QuickBooks Online?

Steps to enter transactions with Undeposited Funds

If you want to enter the transactions with undeposited funds, you need to follow a step by step process. The steps involved are as follows:

- The very first step is to click on the ‘Lists‘ menu, followed by selecting the ‘Items‘ option.

- The next step in the process is to select the option of payment from the ‘Type drop-down list‘ and then add any additional information for the transaction, if needed.

- Lastly, the user is supposed to tap on ‘Account drop-down list‘ and also select the “Undeposited Funds“, followed by hitting “OK“.

How to Deposit Undeposited Funds in QuickBooks?

The user can implement the steps below for depositing Undeposited Funds Account to Receive Payments in QuickBooks Online–

- To begin with, the user is required to hit ‘Banking‘ tab and then select the “Make Deposits“ option.

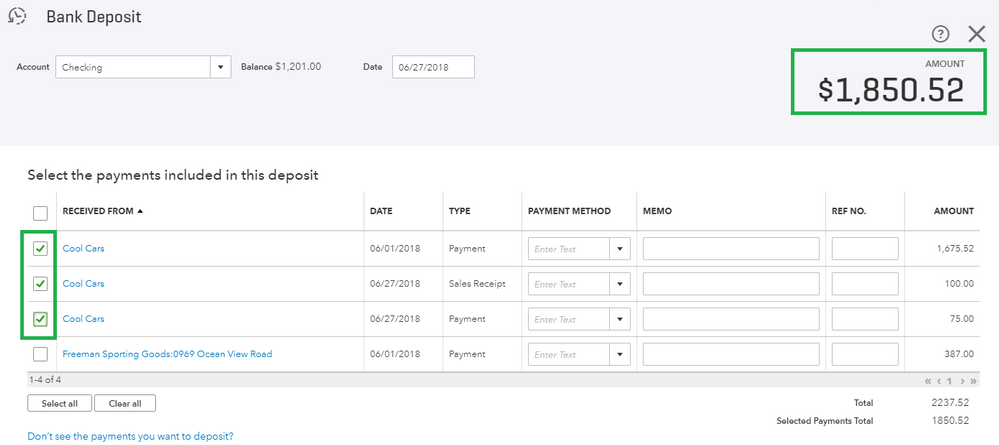

- The next step in the process is to select the payments from Undeposited Funds that the user wishes to deposit. In case the “Payment to Deposit” window does not open on its own, then in that case the user is required to select “Payments” on the “Make Deposits” window.

- Now, the user should hit ‘OK‘ button.

- Moving ahead, click on the ‘Deposit To list‘ and then opt for the bank account for the deposit purpose.

- Once done with that, the user is required to type in the date in the ‘Date field‘ and then if permitted enter any additional payments to deposit.

- The next step to be performed by the user is to click on ‘Print‘ option so that the user can have a hard copy of deposit slip.

- The last and final step is to hit ‘OK‘ so that the transaction can be saved and after that take the slip to the bank and deposit the funds into the account.

Read Also: Resolve Error – “You are Currently not Subscribed to any Services” in QuickBooks

Additional Suggestions

The user can make the best use of the Un-deposited Funds account, in case the company accepts the transactions all day by cheque or cash and later on deposit them in the bank in a single trip. Companies that accept only credit cards as payment option, they deposit one transaction at a time straightforward to the bank account, and other online payments basically do not use the Undeposited Funds account.

If you are not using an undeposited funds account just because of unawareness of the procedure to use it, then reading this article will help you to make the best out of it. However, if any of your queries remain unanswered regarding undeposited funds account, then do not hesitate in discussing it with our QuickBooks Online Support team.

Simply make a call at our toll-free number i.e. +1-888-510-9198, and our experts and certified QuickBooks professionals will be there to provide you with proper support in a single call. Hope this article will be helpful for you. Thanks for your visit. Love to see you soon here again.

FAQs Related to Undeposited funds Account in QuickBooks

Undeposited funds is simply a holding account that usually tracks payments received from customers that have not been deposited to the bank account.

You can correct the undeposited funds in QuickBooks using the steps below:

1. Click on the +New tab

2. After that, choose Bank deposit

3. From account ▼dropdown, select the account you wish to put the money into.

4. Enter a checkmark on the boxes for each transaction.

5. Further click on save and close.

Well, it can have both debit as well as credit balance. When you get the payment, the balance will be debited to the undeposited fund account, and when you make the deposit entry, the account will be credited with the amount of the deposit in the QuickBooks.

Read also:

Steps to resolve QuickBooks error 6007

How to Fix QuickBooks Error Code 80070057?

Enhanced Inventory Receiving on Transactions in QuickBooks Enterprise