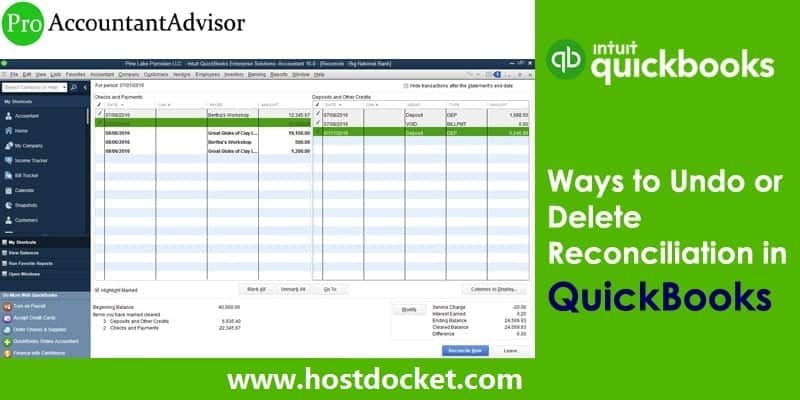

QuickBooks accounting software is loaded with tons of features and functionalities, one such feature is to undo or delete reconciliation in QuickBooks. Often when the user reconciles an unwanted transaction or enters a wrong date or an incorrect statement date, the need to undo or delete the reconciliation arises. This is when the QuickBooks users make use of this feature. Another situation where the user might need to undo reconciliation is when the QuickBooks balance sheet doesn’t match the bank statement following a monthly reconciliation. There are certain steps that can be performed to undo or delete reconciliation in QuickBooks, which we will be discussing later in this segment. To unleash the steps involved, make sure to read the segment till the end. Moreover, you can also connect with our tech personnel at +1-888-510-9198 and ask them to help you with the undo or deletion process.

What is the need to undo Bank Reconciliation?

At times, it becomes obligatory to undo reconciliation or delete a reconciliation in QuickBooks, especially when the QuickBooks balance sheet doesn’t match the bank statement. Here are a few situations when you might need to undo a bank reconciliation. Let us have a look:

- The payment was recorded for an inaccurate date.

- A transaction was appropriately checked off and discovered that it had not cleared yet.

- The bank reconciliation was forced and now requires it to be corrected in a proper method.

- The bank statement date was incorrect or not an actual day.

It should be noted that small changes can unbalance your accounts. You can minimize the impact by reconciling transactions one at a time.

Benefits of Account Reconciliation

Reconciling accounts ensures accuracy and various other perks. Here are a few perks associated with account reconciliation.

- Reconciliation allows you to look for any sort of error in account and bookkeeping activities.

- It prepares you for any further activity. For example: In case you pay a check to any vendor, and he/she continues to delay the payment, then in such case, it is probable that you might miss out to deduct it from the account. Whereas, using reconciliation can help you in keeping track of all the transactions.

- You can further keep the business deposits correct with reconciliation.

Follow the below steps to undo or delete a reconciliation of an account

Below are the following steps to undo or delete a reconciliation of an account

- The first thing to do is go to Banking in the left menu.

- After this select Banking on the top

- Now choose the Account at the top.

- After this above the Action column select Go to Register/Account History

- Now search for the transaction that you require to reconcile but one at a time.

- Then highlight tab on the transaction.

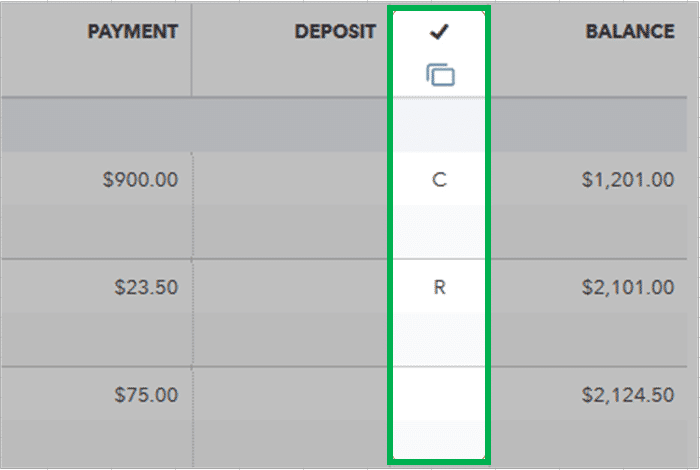

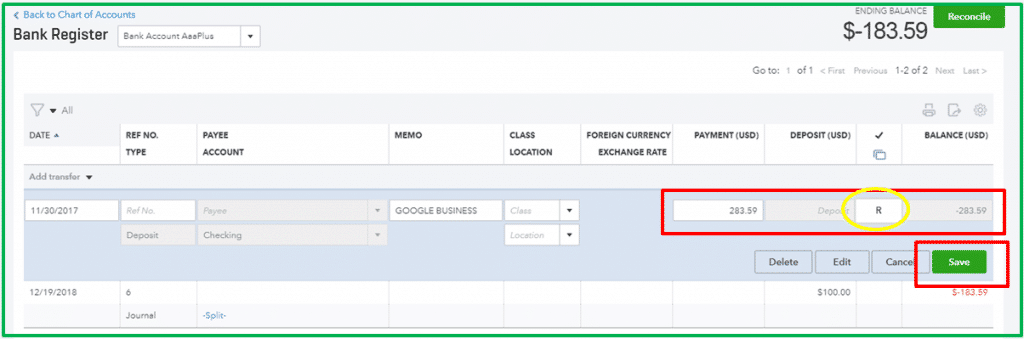

- After this tap on the R which is on the top line of the transaction which is situated between the Amount and Deposit or charge and payment amount.

- By clicking in this field will allow you to change the status of the transaction to the desired status from Blank=unreconciled to C=Cleared

- Now click on Save.

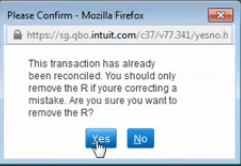

- A pop up will display as the image you are showing in below:

- you have to click on Yes.

Also Read: How to Setup Intuit Go Payment?

Steps to Undo Bank Reconciliation In QuickBooks Online Accountant Version( QBOA)

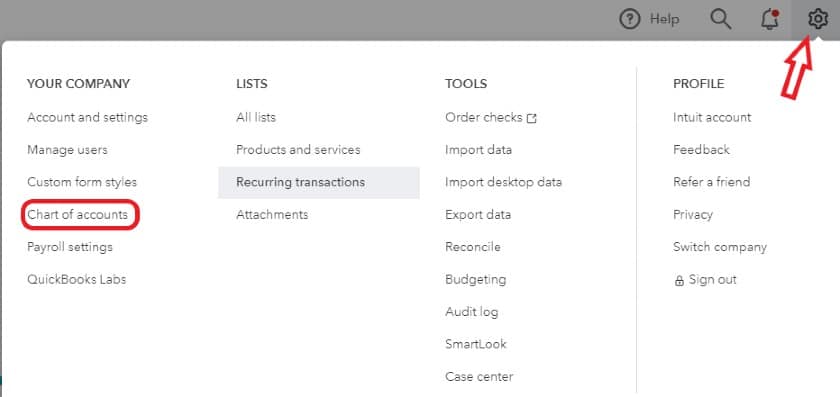

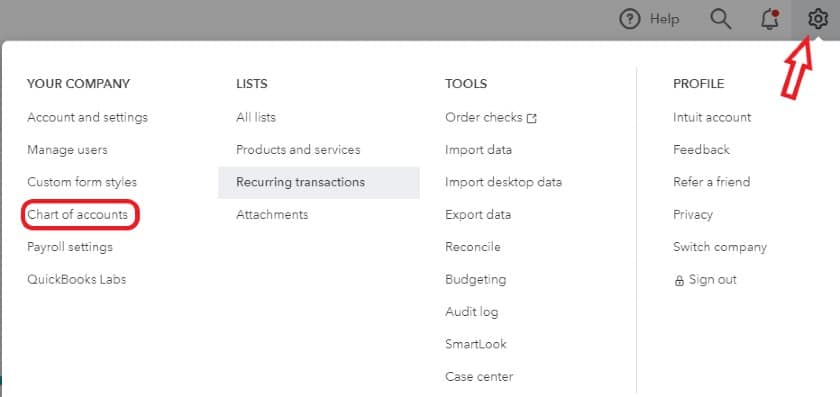

- First of all, you require to click on the “Gear” icon.

- After that click on the “Reconcile” under tools.

- Once more, you need to select the bank account that you want to “Undo reconciliation”.

- Now, just keep your mouse over the reconciliation month you want to undo.

- Throughout that time you will notice an UNDO button to the right of the auto Change column.

- After that simply click on the UNDO button.

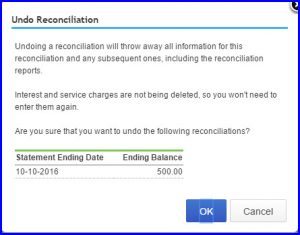

- After that the following message will show up on your computer screen:

- You need to click on OK button here.

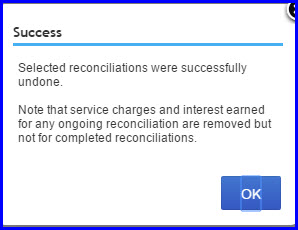

- Now you will see the success display with the following message.

- Finally Click on OK button.

You may also like: How to Fix QuickBooks Error 1920?

In QuickBooks Online

The QuickBooks Online reconciles the transactions separately and that’s why you have to reconcile one at a time.

- In the start, you need to select Registers from the Banking Menu and after that choose the Account from the Register Name drop-down menu.

- After this, you have to tap on the transaction that you want to reconcile and then delete R at the top of the transaction in order to modify its rank to the unreconciled.

- In case you want to reconcile each part of the transactions for a period of time then it may help to print a list of the reconciled transactions by using the reconcile alternative from the banking menu.

In QuickBooks Desktop Versions

If you have QuickBooks Desktop version like QuickBooks Pro or QuickBooks Premier, then you can unreconciled a complete reconciliation by tapping on Reconcile Now from the Banking screen and then choose Undo Last Reconciliation. But before do it you have to click on Locate Discrepancies so as to produce a list of discrepancies to find the mistake. Well, the process to undo reconciliation in QuickBooks desktop is the easiest amongst all. The steps

below will help in undoing reconciliation for QuickBooks desktop versions like QuickBooks pro, premier,

and enterprise. The steps involved are as follows:

- The user needs to first launch QuickBooks and then move to the banking option

- Once done with that search for the transaction that you wish to reconcile

- The next step is to hit the Reconcile Now tab

- End the process by opting for the option to undo the last reconciliation

Steps to undo reconciliation manually

- The very first step is to hit the gear icon and also pick the chart of accounts tab

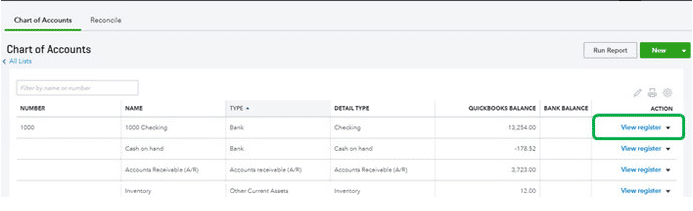

- Later on, look for account row that you wish to see

- Once done with that go for account history/view register

- Furthermore, spot the particular account you wish to edit and then head to the reconcile status shown by the checkmark

- The last step is to select the top mark to change it. It is suggested to choose the acronyms: C(Cleared), R (reconcile), and blank (neither cleared not reconcile)

Undo an entire reconciliation

Before you begin, you need to download any attachments tied to the reconciliation. When you undo a reconciliation deletes all existing attachments.

Important points:

- When you undo an earlier reconciliation, it also undoes all of the reconciliations that follow. For instance, in case it is May and you undo January’s reconciliation, then you will also have to undo Feb, March, and April, as it may cause errors. You need to start with the most recent reconciliation and work your way backward.

- Further, undo reconciliation doesn’t work on manually reconciled transactions. The transactions that remain in the register for the dates that were undone might have changed manually. You can also check the transaction audit history.

- You need to sign in to QuickBooks Online Accountant.

- Further, find and open the customer’s QuickBooks online company.

When you are in their company file:

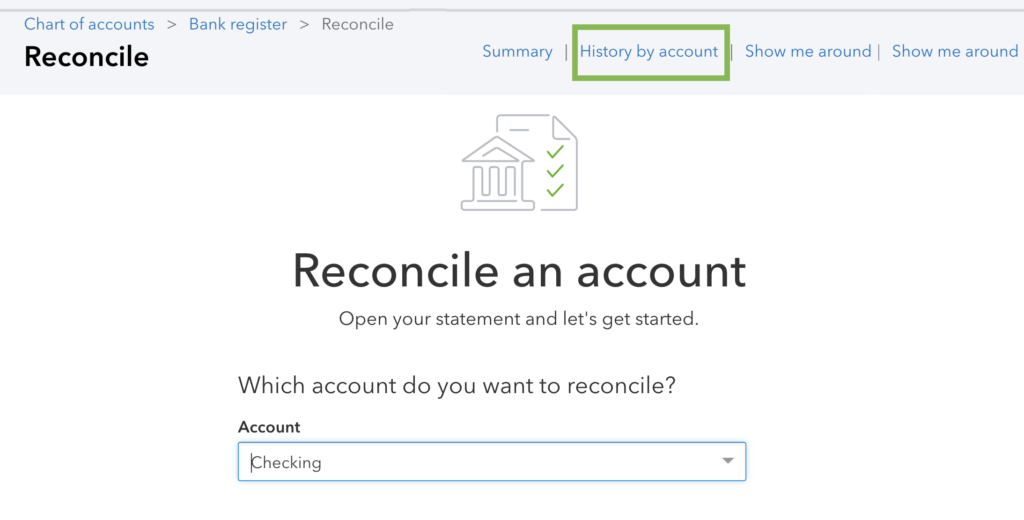

- Firstly, head to the accounting menu

- After that choose reconcile tab.

- You now have to choose history by account.

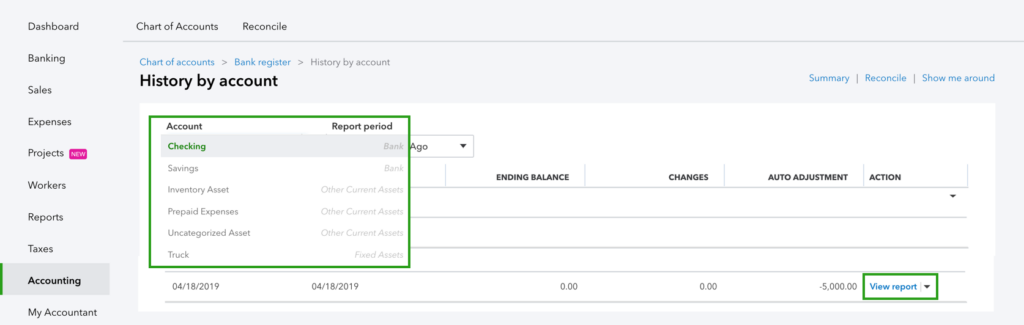

- Choose the account you want to reconcile and date range from the dropdowns.

- Now, find the reconciliation on the list.

- You now have to opt for view report to open the reconciliation report.

- Furthermore, review any discrepancies and changes your client wants to make.

- When you are ready, choose the dropdown in the action column and further choose undo.

- The last step is to choose yes tab and undo to confirm.

It should be noted that, if you do not see Undo, ensure that you have opened your client’s company file from QuickBooks Online Accountant. Now you are you client can redo the reconciliation if required.

Winding Up

If you are still unable to Undo or Delete Reconciliation in QuickBooks then you should seek assistance from the QuickBooks Payroll Customer Service experts. They will in no time help you with the whole process. You can call us at +1-888-510-9198 in case you are facing any issue in your QuickBooks Desktop.

FAQs Related to QuickBooks Reconciliation

How to undo past bank reconciliation in QB online?

In case you are using QuickBooks online accountant, you can use the undo reconciliation feature to unreconcile previous transactions without manually editing individual transactions from within the register.

How to remove one transaction from reconciled account?

It is recommended to make sure that you have opened the client’s company file. and then:

1. Go to QuickBooks in the toolbar.

2. Choose the client’s QuickBooks company and open it.

3. After accessing their books, go to the accounting screen and open the reconcile tab and click on the history by account.

4. Select the account you want to reconcile and specify the date range.

5. Find the appropriate reconciliation and press its view report option.

6. Review the discrepancies/changes the clients want to make.

7. Use dropdown in the action column and click on undo.

8. Choose yes and also click on undo.

Can anyone tell me how to undo the reconciliation of a bank account?

You can undo reconciled transactions one at a time, using the steps below:

1. Head to the accounting menu.

2. Choose chart of accounts

3. Find the account and go for view register

4. To assist you in focusing on this task, filter the register to only include the last 60 days of transactions.

5. Review the check column and choose the box and click on it till it is blank.

6. Now, go for save and close your register.

Why can’t my accountant undo a reconciliation?

There is a problem with reconciliation in QuickBooks that many users are facing. You can contact our Customer Support Team to further understand the error and find out a quick fix.

You May Also Like

How to Set Up a New Company File in QuickBooks