Balancing a balance sheet is one of the most time-consuming task. You should always ascertain that the total number of assets and the amount of liability and equity in QuickBooks balance sheet must always be same. In case the numbers are not in sync, you might receive the balance sheet out of balance issue in QuickBooks. Moreover, regardless of the changes in cash flow, according to accrual basis, The QuickBooks accounting software records revenues and expenses as they occur. And in majority of the cases, the reports might reveal variations in the balance sheet.

However, there are solutions that can be performed to fix the balance sheet out of balance issue in QuickBooks. To understand what those fixes are, make sure that you read this segment carefully, or you can also connect with our technical support team at +1-888-510-9198, and we will help you with your queries immediately.

See this: How to Fix QuickBooks Error Code 6150?

What is Balance Sheet Out of Balance Error in QuickBooks?

A balance sheet is basically a statement of business-related data that jots down the assets and liabilities of a business. A balance sheet needs to be equal on both the asset and liability side. The balance sheet out-of-balance error indicates the contrast between the aggregates of assets and liabilities. There can be a bunch of reasons behind the occurrence of such an error, which we have discussed later in this segment.

Know When Your Balance Sheet Went Out of Balance

To know when your balance sheet went out of balance, you simply need to carry out the steps below:

- You need to first open Reports and choose Company and Financial.

- Once done with that, you need to head to the balance sheet summary and select Customize report.

- After that, click on the display tab.

- And also, set the report basis to cash.

- Perform necessary changes in the columns as per the year/month/week/day when the QuickBooks balance sheet out-of-balance issue occurred.

Common issues leading to Balance Sheet Out of balance

You need to check in case any type of transaction is causing the balance sheet out of balance in QuickBooks. You need to keep a check on the following transactions.

Inventory return and discount on an invoice.

| Possible Scenarios | Recommended Fix |

| One or more inventory items are sold. | For the Sale and the discount, you have to create a new invoice. |

| The customer returns one or more inventory items. | For the inventory return, create a credit memo. |

| Discount items are there. | In the Receive Payments, link the credit memo. |

Unconventional Inventory Transactions

| Possible Scenarios | Recommended Fix |

| 1. Transaction Reports that adversely affect your inventory such as # Transactions which make your Quantity on Hand negative. # Transactions records that revert the Quantity on Hand for the last entered assemblies and cause the assemblies to be labeled pending. # Washing Transactions with (-) and (+) units of the same item on the same price. # Transactions that use a damaged item and a damaged customer or vendor are damaged. You have a negative inventory that affects your Cash Basis Balance Sheet. You have tried implementing basic data damage troubleshooting your company file when your Balance Sheet becomes out of balance one more time. | 1. Transaction Reports that adversely affect your inventory such as # Transactions which make your Quantity on Hand negative. # Transactions records that revert the Quantity on Hand for the last entered assemblies and cause the assemblies to be labeled pending. # Washing Transactions with (-) and (+) units of the same item at the same price. # Transactions that use a damaged item and a damaged customer or vendor are damaged. You have a negative inventory that affects your Cash Basis Balance Sheet. You have tried implementing basic data damage troubleshooting your company file when your Balance Sheet becomes out of balance one more time. |

A Discount Applied at Job Level When Entered At Customer Level

| Possible Scenarios | Recommended Fix |

| # Your cash basis balance sheet will be out of balance. You have a customer with several jobs. You receive a payment for the invoice, but your customer includes a discount for Job in the payment. # Enter or record the payment to the invoice when you Enter the discount on the credit tab. # You completed all of the jobs and invoices of the customer, including all jobs on the invoice. | # You have to re-enter the payment and crack open it among the job. Now enter discount at the job the level so it matches the invoice. |

Journal Entry linked to a credit memo

| Possible Scenario | Recommended Fix |

| # Open Credit Memo and enter an offsetting General Journal Entry (GJE) and then link it to the Credit Memo. | # Edit Journal Entry. # Move the A/R account to the source line, generally the first line of the GJE. # Save the GJE and ensure it still linked to Credit Memo. |

Discount that offsets to a Balance Sheet account.

| Possible Scenario | Recommended Fix |

| # You have recorded a discount and used a Balance Sheet account to offset the discount. | Change the discount account to an income or expense account. If you are instructed by your accountant to use a Balance Sheet account, and it is essential that you have to use Accrual basis reporting, instead apply this: # Offset the discount to an expense account. # Make a journal entry moving the discount from the accounting expense to the account of the balance sheet. # This will pop the discount to the Balance Sheet account while keeping your Balance Sheet in balance. |

Essential Points To Remember for Balance Sheet out of Balance issue in QuickBooks

Test the Balance Sheet Report

- Backup of your QuickBooks company file must be created.

- If the report is back in your balance after then you need to change the report to total by Year.

- For more information check Balance sheet Report out of balance- Recurring.

- If the report is back that you have to log out and login back into your balance sheet report.

- Make sure to repair the server computer, if you are using QuickBooks multi-user environment.

Quick Fixes to Balance Sheet Out of Balance Issue in QuickBooks

Before you perform the detailed steps to rectify the QuickBooks balance sheet out-of-balance issue, it is essential to perform some quick steps.

- You need to modify the reported total by the year and then check if the balance sheet is back in balance.

- Log out the QuickBooks file and then log back in. Furthermore, check if the balance sheet is back in balance.

- Back up QuickBooks company file before carrying out any troubleshooting steps.

- In case you are working in a multi-user environment, then it can end up in damaged company file and the balance sheet might go out of balance. Thus, you need to fix data damage and use the main system from where the file is being hosted.

- Verify and rebuild QBWIN logs before proceeding.

How to solve the Balance Sheet out of Balance Issue in QuickBooks?

Here are the measures that can be performed to fix QuickBooks balance sheet out of balance. Let us explorer

Solution 1: Troubleshoot basic data damage

- Run the rebuild and verify data utilities.

- Fix the data damage problem using qbwin.log

- Reopen the Balance Sheet and then check the balances.

Read Also: How to Fix QuickBooks Error 6000?

Solution 2: Fix the transactions manually

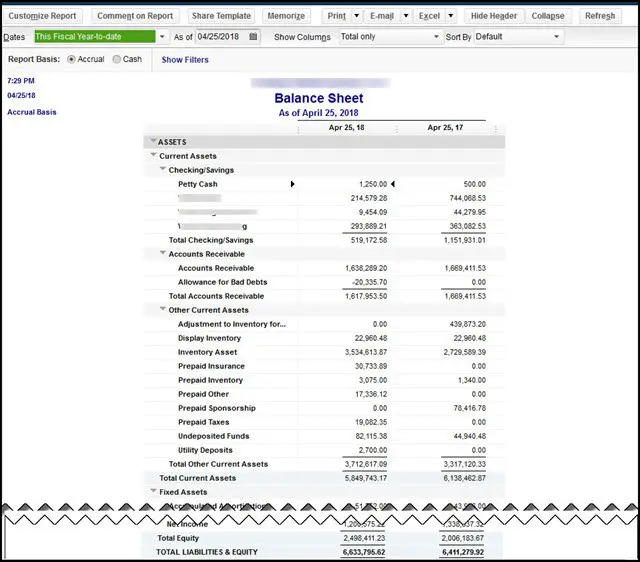

Step 1: Verify the date when the Balance Sheet runs

- Click on Reports menu and then select the Company & Financial.

- Click on Balance Sheet Summary.

- Go to the upper left side of the Summary Balance Sheet window and select the Customize report.

- Switch Report Basis to Cash.

- Sleek down the Report Date Range and the columns to determine when the Balance Sheet goes out of balance.

Year

- Select All, from the Dates drop-down.

- Click on Year from the Display columns by drop-down.

- Click on OK.

- Differentiate the Total Assets and Total Liabilities so that you can find the year in which the Balance Sheet goes out of balance.

- Redirect to Month.

Month

- In the To Fields and From entering the year the report has gone out of balance.

- Click on Month, from the Display columns by drop-down.

- Select OK.

- Check the Total Assets and Total Liabilities to find in which month the Balance Sheet goes out of balance.

- Now, proceed to Week.

Week

- Click on From and To fields, enter the month the report goes out of balance.

- Select Day, in Display columns by drop-down.

- Click on OK.

- Verify the Total Assets and Total Liabilities to find the week the Balance Sheet goes out of balance.

Day

- Enter the day the report goes out of balance, in the From and To Fields.

- Select Day, in the Display columns by drop-down.

- Click on OK.

- Verify the Total Assets and Total Liabilities to find the day the balance sheet goes out of balance.

You may also like: How to Fix QuickBooks Error 404?

Step 2: Find the transactions causing the issue

- You have to enter the date/s when the Balance Sheet goes out of balance, to help you identify the transaction/s causing the problem to create a Custom Transaction Detail Report.

- Click on Reports menu and then select the Custom Report.

- Click on Transaction Detail.

- The Modify Report window should open and if not then select Customize Report and then go to the Display tab.

- From Report Date Range, enter the date when your Balance Sheet went out of balance in the From and to fields. Example: From= 3/14/00 To 3/14/00.

- Make Report Basis to Accrual.

- Uncheck Account, Split, Clr and Class then check Amount. It will make the report more comfortable to read.

- Select OK.

- The ending balance on this report will be the amount that is out of balance.

- Verify the Amount column for a transaction that equals the balance of end of the report. In case there is a single transaction which matches the ending balance then implement step 3.

- If you are not able to find the transaction/s which is responsible, then run the following reports.

Customer Report

- Click on Reports menu and then select Customer Reports.

- Click on Transactions Details.

- Customize the Display tab:

- Change the Report Basis to Accrual.

- Customize the From and To Fields to the day the Balance Sheet has gone out of balance.

- Change Total by Customer.

- Click on Filter tab and then:

- Onto the Filters list, click on Transaction Type.

- Select Multiple Transactions from the Transaction Type drop-down and then mark Invoice, Credit Memo and Payment.

- Click on OK.

✔ If the total is the amount by which the Balance Sheet went out of balance of this date: Identify the customer who has a non-zero (negative or positive) subtotal.

✔ If the total is non-zero (negative or positive) and the Balance Sheet went out of balance on this date by both the amount. Add other transactions to the Transaction Type filter such as Journal Entries and Checks.

Vendor Report

- Click on Reports menu and then click on select Customer Reports and then click on Transaction Detail.

- Modify Report window will open automatically. If it does not open, then you can select Customize Report, to do that click on the Display tab.

- On the Display tab:

- Change the Report Basis to Accrual.

- Alter the From and To Fields to the day the Balance Sheet goes out of balance.

- Change Total to Customer.

- Click on Filter tab:

- Select Transaction Type, on the Filters list.

- Select Multiple Transactions and then mark Bill and Bill Credit and Bill Payment.

- Click on OK.

✔ If the total is the amount by which the Balance Sheet went out of the balance on this date: Verify the vendor who has a non-zero (negative or positive) sub-total. This Vendor is the reason for damaged transactions.

✔ If the total is non-zero (negative or positive) and not the amount by which the balance sheet went out of the balance on this data: Add other transactions to the Transaction Type filter such as Journal Entries.

Journal Report

- Click on Reports menu and then select Accountant and Taxes.

- Click on the Journal button.

- Select the Customize Report and then go to the Display tab.

- Change the Report Basis to Accrual.

- Change the From and To fields to the day the Balance Sheet goes out of the balance.

- Click on OK.

Important Note: The Credit and Debit Totals will not match, which indicates that you have the right date when the Balance Sheet is out of balance.

Other transactions

- Click on Reports menu and then select Custom Report.

- Click on Transaction Detail.

- A Modify Report window will open automatically, and if does not then you have to click on Customize Report and then redirect to Display tab.

- From the Display tab:

- Select the Report Basis to Accrual.

- Choose All, from the Dates drop-down.

- Change Total by to Account List.

- Mark Item, from the Columns list.

- Click on OK.

- Go to the bottom of the report, if the last group of transactions has the heading No account and the Account column is blank, and then these transaction targets have no accounts assigned to them. Fix this by:

- Click Item List from the Lists Menu.

- Click on Edit Item by right click on the item.

- Change the Account.

- Select OK.

- You can repeat all the steps for every transaction on the above given report that does not have an account.

- Determine whether a particular type of transaction is putting the Balance Sheet out of Balance issue in QuickBooks.

You may also see: How to Fix QuickBooks Error 6129, 0?

Solution 3: Check and resolve specific forms of data damage

If there are not transactions leading the Balance Sheet to be out of balance, you will have some data damage that usual data damage resolution cannot fix. The options mentioned below provide some specific forms of data damage troubleshooting you can do. Ensure that you have created a backup before going through any of them.

Summary of Balance Sheet is out of balance while the Balance Sheet Details are in balance or vice versa.

Solution 4: If both reports have the same basis and the same data range then you may have a corrupted account.

To solve this follow the steps mentioned below:

- Differentiate the two reports. Identify the account/s having two different amounts on the two reports.

- Combine the corrupted account into a new account.

NOTE: You can only combine accounts which are the same type.

- First of all you need to go to the Lists menu.

- Now Select Chart of Accounts.

- Right-click on the damaged account.

- Click on Edit Account.

- Add an asterisk (*) to the name of the account.

- Click on Save & Close.

- Perform right-click operation and then choose New.

- Recreate the original account with its original name.

- Click on Save & Close.

- Right-click on the original account, then select Edit Account.

- Remove the asterisk (*) from the name.

- Finally Click on Yes to confirm that you are agree to combine the 2 accounts.

Accrual Basis Balance Sheet is in balance for Dates= All Dates, but out of balance for any other range of data.

Read Also: How to Fix QuickBooks Error 6190 and 816?

Solution 5: Find and repair damaged transactions for Balance Sheet out of Balance issue in QuickBooks

- Firstly, You need to create a backup of QuickBooks company file.

- Now Go to the Lists

- Then, Select the Chart of Accounts.

- Perform the right-click operation on the Uncategorized Expense account.

- Click on QuickReport.

- Now customize report.

- After that click on the report date range and then select all.

- Tap on filters menu and select the posting status.

- Select All, from the Dates drop-down.

- On to the Filters tab and then select Posting Status from the Filters list.

- Click on Either and then select OK.

- Repair each transaction.

Your accrual Balance Sheet is out of balance, but your cash Balance Sheet is in Balance.

Solution 6: To repair this, you have to identify damaged income or expense accounts that have a balance but have nil transactions and then combine them into the new accounts.

Learn the difference between assets and liabilities.

- Click on the Reports menu and then select Company & Financial.

- Click on Balance Sheet Standard.

- Tap on the Customize button.

- Select All from the Dates drop-down.

- Change Report basis to Accrual.

- Note down the difference between Liabilities & Equities and Assets.

Search the corrupted or damaged account.

- Export your chart of accounts and then open the file in MS Excel.

- Highlight the first two rows of the spreadsheet and then delete them.

- Highlight Column G-onwards and then delete them. These columns not needed for our purposes.

- You have to see OBAMOUNT in Column F and Row 1.

- Choose the cell above Row Header 1 and left of the Column Header A to highlight the whole spreadsheet.

- Sort the whole spreadsheet by Column F.

- Search the row whose Column F amount is the difference between the Liabilities & Equities and Assets.

- Make sure to write down the name of the account.

Fix the damaged account

- In QuickBooks, run a QuickReport for All Dates on the account listed in Step 3B-8 above in QuickBooks.

- If there are no transactions, then the reason is in Account.

- There should be no balance if there are no transactions in the Account.

- Make a check for one cent ($0.01) to this account.

- Run the basic data damage troubleshooting on the company data file.

- QuickZoom (double-click) on the account and delete the check for one cent.

- Finally Run the accrual basis balance sheet to be sure it is in balance.

If your Balance Sheet is out of balance and the JE’s displays the amounts without associated accounts.

After Condensing your data, your balance sheet is out of balance, and the JE’s show amounts without associated accounts.

Solution 7: Correct the affected journal entries:

- This problem will occur if you change the associated account on a payroll item after it was used on a paycheck and then run the Condensed utility.

- Restore your company data file from the backup you made before you condensed your data.

- Click on Reports menu and then select Accountant & Taxes.

- Click on Transactions List by Date.

- Verify the report for Transaction Type: Journal and All Dates.

- Slide down and identify any Journal Entries showing an amount without an associated account.

- Double-click the report entry to open the Make General Journal Entries window.

- Click on Edit menu and then select Delete General Journal.

- Again, go to Edit menu and then click on New General Journal.

- Select Save and New.

If One column setting (e.g. Total Only) shows out of balance, other column settings (e.g., by Year) show in balance.

When viewing a Balance Sheet, total assets match total liabilities and equity in some column views, but not in others. One or more of your accounts may be damaged.

Solution 8: Identify the damaged account and merge it into a new one.

Know which view of the report data is out of balance:

- Click on Reports menu and then select Company & Financial and then click on Balance Sheet Summary.

- After that click on Dates drop-down arrow and select All.

- Now tap on OK.

- Onto the Columns drop-down arrow, select Total only and then note whether Total Assets match Total Liabilities and Equity.

- When total does not match in at least one column, then note the column.

- From the Columns, drop-down arrow, note whether Total Assets match Total Liabilities and Equity for all the columns onto the report.

- If the total does not match in at least one column, list the column heading of the earliest instance where the totals not match.

Verify the damaged account:

- Click on Reports menu and then select Company & Financial.

- Choose Profit & Loss Standard.

- Enter a date range in the From and To fields that match the column heading you noted in Step 1. Select OK.

- On the report, Audit the integrity of each account:

- Note the amount next to the first account displayed on the report.

- Double-click the amount to open the Transaction Detail by Account

- Scroll to the bottom of the report and note the total in the Balance

- Close the Transaction Detail by Account

Combine the corrupted account(s) with the new one(s).

Your Balance Sheet is out of balance on both Accrual and Cash bases.

Solution 9: To fix this, verify and solve transactions which do not have accounts assigned.

- Run the Custom Transaction Detail report

- Change the Dates to All.

- Now Change the Basis to Cash.

- Change Total by to Account List.

- Add Item column.

- Finally Click on OK.

Now Scroll down of the report. If the last group of transactions has the heading No account and the Account column is vacant, then in that case transaction Targets have no accounts assigned to them. Try the method below:

- Open the Edit Item window for the Item.

- Set the Account and click on OK.

- Restart the Edit Item window.

- Change the Account back to the original account and then click on OK.

For the above report that does not have an account, You have to repeat Steps 1 – 4 for each transaction.

Read this also: How to Fix QuickBooks Error Code 6150, -1006?

Final Note!

We hope that this blog has helped you a lot in resolving a Balance Sheet out of Balance issue in QuickBooks accrual basis and if not then feel free to seek advice from our Intuit Certified QuickBooks ProAdvisors by calling on their 24×7 QuickBooks toll-free helpline Number .i.e. +1-888-510-9198.

Other Related Articles:

QuickBooks Certification: How To Become QuickBooks Certified?

How to Fix QuickBooks Error Code 3003?

QuickBooks Component Repair Tool

Some FAQ Related to Balance Sheet Out of Balance in Accrual Basis Error

A balance sheet out of balance in accrual accounting occurs when the sum of the debits does not equal the sum of the credits in the balance sheet. This can happen if there are errors in recording transactions or if adjustments have not been made to reflect accrual accounting principles.

One way to resolve a balance sheet out of balance in accrual accounting is to review all transactions and make sure that they have been recorded correctly. If you need further assistance, feel free to call our toll-free number at +1-888-510-9198. Our team of experts will be happy to assist you.

To prevent a balance sheet out of balance in accrual accounting in the future, it is important to have a clear understanding of accrual accounting principles and to ensure that all transactions are recorded correctly. If you have any questions or concerns, please don’t hesitate to call our toll-free number at +1-888-510-9198.