Struggling with making payments to employees and contractors? Well, the QuickBooks direct deposit form is one of the most convenient ways to pay your employees and contractors. This eliminates the hassle of handwriting or printing paychecks each payday. It further helps employers collect relevant employee information to manage payroll. Moreover, the employer can collect employee bank details and essential authorization to pay salary with a standard direct deposit form. In case the employer wants the employees to enter their own personal, tax, and banking info, ensure employee self-setup is on. QuickBooks will automatically email them an invite through QuickBooks workforce.

To brief you with the entire procedure to fill direct deposit forms, here we are with this piece writing sharing the complete set of steps and information. For more details, make sure to scroll through this piece of writing, or you can connect with our technical support team at +1-888-510-9198, and we will provide you with the right guidance instantly.

Also Read: Create an invoice in QuickBooks Online

What is direct deposit form in QuickBooks?

The direct deposit form gives authority to a third party i.e., often the employer for payroll to send money to a bank account by simply making use of the account details. An employer might require a canceled check to verify the accounting information. After the form is completed by the account holder, it must be signed and returned to the employer.

Note that, in order to make payments to your employees and contractors through direct deposit, you will be required to have a U.S. bank account that’s set up for ACH transactions. Also, there are fees to use direct deposit. You can check your payroll subscription for further related information.

Steps to set up direct deposit for employees

You can try performing the below set of steps to set up direct deposit for employees. Let us explore the steps one by one:

Step 1: Setting up company payroll for direct deposit

- Identify and get access to your business, bank, and principal officer info

- Connect your bank account

- Verify your bank account

- Set up your employee’s direct deposit

Step 2: Get a direct deposit authorization form

If your employees have filled out, signed, and dated a Direct Deposit Authorization Form and attached a voided check from the employee’s bank account, then choose your payroll for the next steps.

QuickBooks Online Payroll

- You need to first head to taxes and further choose payroll tax.

- Once done with that, choose filings and further opt for employee setup.

- Heading forward, you need to choose bank verification next to authorization for direct deposit.

- The last step is to choose the view option.

QuickBooks Desktop Payroll

You need to obtain a completed direct deposit authorization form and a voided check from the employee’s bank account. It should be noted that there is no need to submit the authorization form and void check to QuickBooks, as they are just for recording purposes.

Also Check This Out: How to Move or Convert your QuickBooks Desktop files to QuickBooks Online?

Step 3: Adding direct deposit to your employees

After completing this setup, the next paycheck created by you for the employee will be a direct deposit. You need to choose your payroll for setup.

QuickBooks Online Payroll

- You need to first navigate to payroll, and further choose employees.

- The next step is to choose your employee.

- Also, from the payment method, opt for start or edit.

- Now, from the payment method dropdown ▼, you need to choose direct deposit.

- Further, choose a direct deposit method (Splits can be done as a dollar amount or as per percentage).

- Direct deposit to one account

- Direct deposit to two accounts

- Direct deposit with balance as a check

- Now, enter the routing and account numbers from the employee’s voided check and further hit done.

Must Read: How to Solve QuickBooks Bank Reconciliation?

QuickBooks Desktop Payroll

In case the employee’s bank shows that the account should be tagged as money market, then inform the employee that QuickBooks desktop only accepts checking or savings accounts, so they should choose the checking option.

- Here, you need to first choose employees and then opt for the employee center to open your employee list.

- Once done with that, choose the employee’s name.

- And further, opt for the payroll info tab.

- You now need to choose the direct deposit tab.

- In the direct deposit window, choose use direct deposit for the employee’s name.

- Moving ahead, choose whether to deposit a paycheck into one or two accounts.

- Followed by entering the employee’s financial institution information such as bank name, routing no., account no., and account type.

- Now, if you are opting to deposit to two accounts, then you need to simply enter the amount or percentage that the employee wants to deposit to the first account in the amount to deposit field.

- The remaining goes to the second account.

- Further, you need to choose the OK tab to save the information.

- And lastly, enter the direct deposit PIN when asked to.

Also Read: How to print W-3 form in QuickBooks Online and Desktop?

Steps to get employee direct deposit authorization form

In order to get to the employee direct deposit authorization form in QuickBooks online, you need to first navigate to the filing resources window and further set up employees’ direct deposits in payroll. Note that the employees or contractors who will be paid by direct deposit should complete the employee direct deposit authorization form. To get this, you need to continue with the steps below:

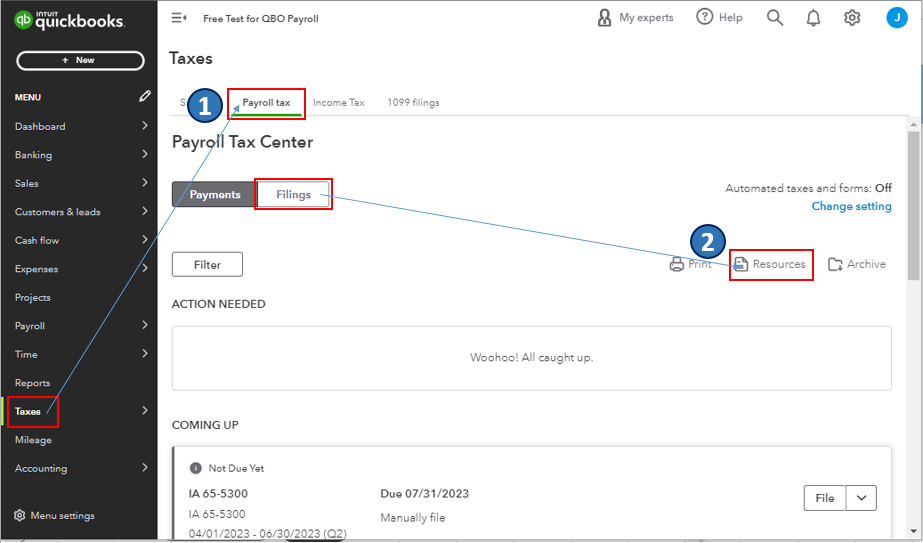

- Initially, head to the taxes menu.

- Further, opt for payroll tax.

- You now have to choose the filings tab, and also click on resources

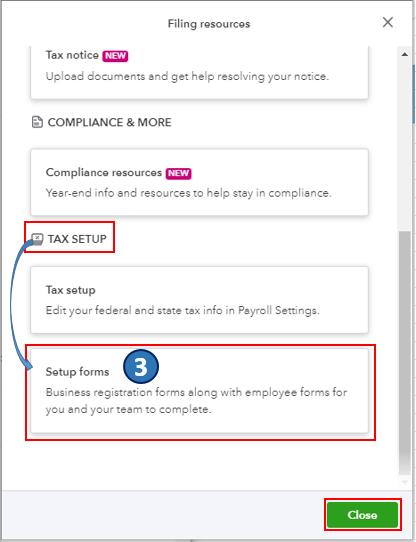

- Heading forward, in the filing resources window, you need to scroll down to the tax setup section.

- And later on, choose setup forms.

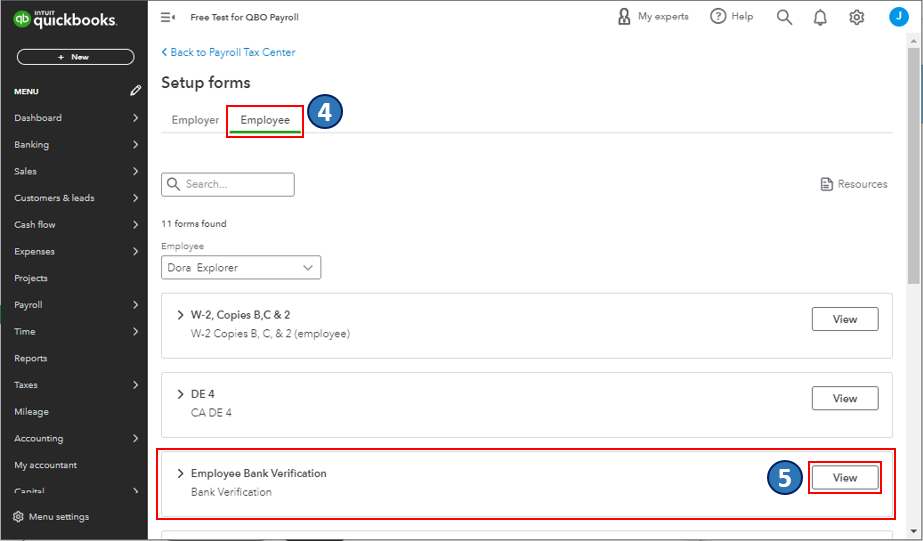

- Now, navigate to the employees tab.

- Also, find the employee bank verification section and hit the view tab.

- Now, you will be routed to the form’s PDF file.

- From there, download and print the employee direct deposit authorization form.

After you are done with this, carry out the necessary steps to set up and manage employee direct deposit in the payroll listed above. Moreover, there are a variety of payroll reports that you can make use of to view information about the business finances and employees.

You might find this helpful: How to Use Undeposited Funds Account to Receive Payments in QuickBooks Online?

Conclusion!

QuickBooks Online payroll gives you increased flexibility with employee self-onboarding by letting you enter some of their info. Moreover, you can further invite them to add the rest. Not just that, you can still print a direct deposit authorization form in case you want.

With this segment, we have tried to summarize the complete procedure to set up the QuickBooks direct deposit form. However, if you are doubtful regarding any step, or if you are stuck at any point in time, do not hesitate to connect with our technical support team at +1-888-510-9198, and let them help you with the procedure.

FAQs Related to QuickBooks direct deposit form

Yes, QuickBooks offers a direct deposit form that helps employers collect relevant information related to the employee and further manage payroll.

You can find the direct deposit form in QuickBooks using the steps below:

1. Navigate to the payroll tab.

2. Further, choose employees.

3. Now, from the payment method, select Start or Edit.

4. Heading forward, from the payment method dropdown ▼, choose direct deposit.

You can verify direct deposit in QuickBooks using the set of steps below:

1. Sign in using your Intuit Account login.

2. Now, move to the payroll info section under the direct deposit bank account.

3. After that choose verify.

4. Enter the payroll PIN and confirm.

5. Lastly hit submit to complete the procedure.

A direct deposit authorization form is a form that employees fill out, in order to authorize the employer to deposit money straight into the bank account. Many businesses pay their employees using the direct deposit option.

Other Related Articles:

How to Download Bank Feed transactions in QuickBooks Desktop?

How to Turn off Sales Tax in QuickBooks Online

How to Fix Qbwin.Log: Lvl_error – Verify Online Account Information or Invalid Customer Id Number?