As we all are aware about QuickBooks accounting software which is made especially for a small, medium or a large sized business. It helps to run your business more efficiently with payroll software that is the right option for you to work together. Talking about QuickBooks payroll, it is a cloud based payroll software that lets you to pay employees, file payroll taxes, and further manage employee benefits. Payroll Services also saves a lot of time by automatically calculating, filing, and paying federal and state payroll taxes. After setting up, you can automatically run payroll for your employees. Or if you do not like the automated option, then you can run payroll manually from your system. You can further customize reports to include deductions and contributions, multiple work sites and paid time off. In this article, all users need to pay attention as we discuss about QuickBooks payroll account information that fits your business needs.

In case you are interested in learning more about QuickBooks payroll, make sure to stick around till the end, or you can also get in touch with our technical support team at +1-888-510-9198, and they will help you with all your QuickBooks payroll services related queries.

QuickBooks Payroll Benefits

The time is now to calculate all your accounts as automatically with effortless payroll.

Make Payroll effortlessly by doing following work as:

- Easy to calculate paychecks accurately.

- Simply done all calculation payroll taxes in a automatic.

- Due to QB payroll, avoid tax penalties, by hundred percent guaranteed.

- Works with or without QuickBooks software.

It fits with your Business requirements

- This is really fits your business requirements having multiple flexible pay types & its deductions available here.

- Set up as hourly, an employee’s salary, its time off/on, health care benefits, retirement & more about.

Free Direct Deposit through Payroll

- Through QuickBooks payroll, a user can print checks by using a direct deposit at which colleagues prefers.

Managing payroll taxes easily

- QuickBooks users can file and pay e-taxes electronically as well as automatically. Even they can handle them for you and get a no-penalty as guarantee. This makes the user easier to work through this QB payroll software.

Read Also: How to Fix QuickBooks Banking Error 9999?

QuickBooks Online with Enhanced Payroll Services

Other Additional Features of QuickBooks Payroll as listed below:-

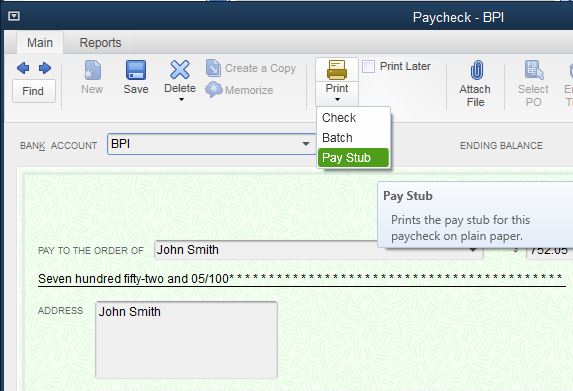

Print Pay Cheque

By using payroll software, get to print pay cheques on pre-printed cheque stock its right from QuickBooks software.

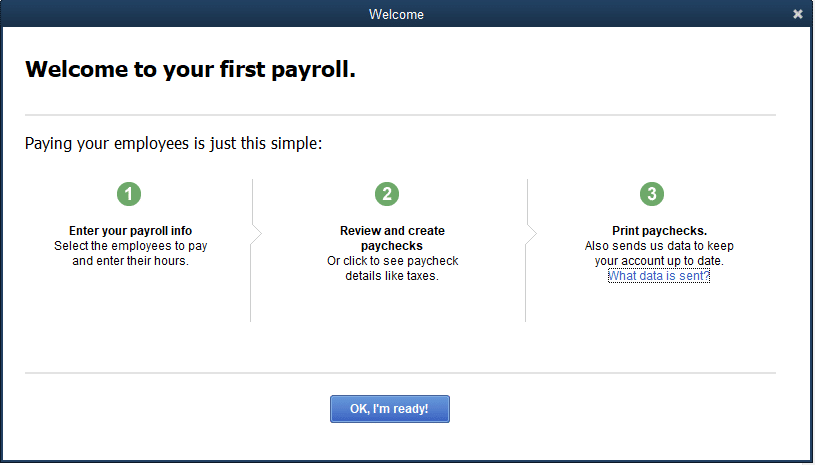

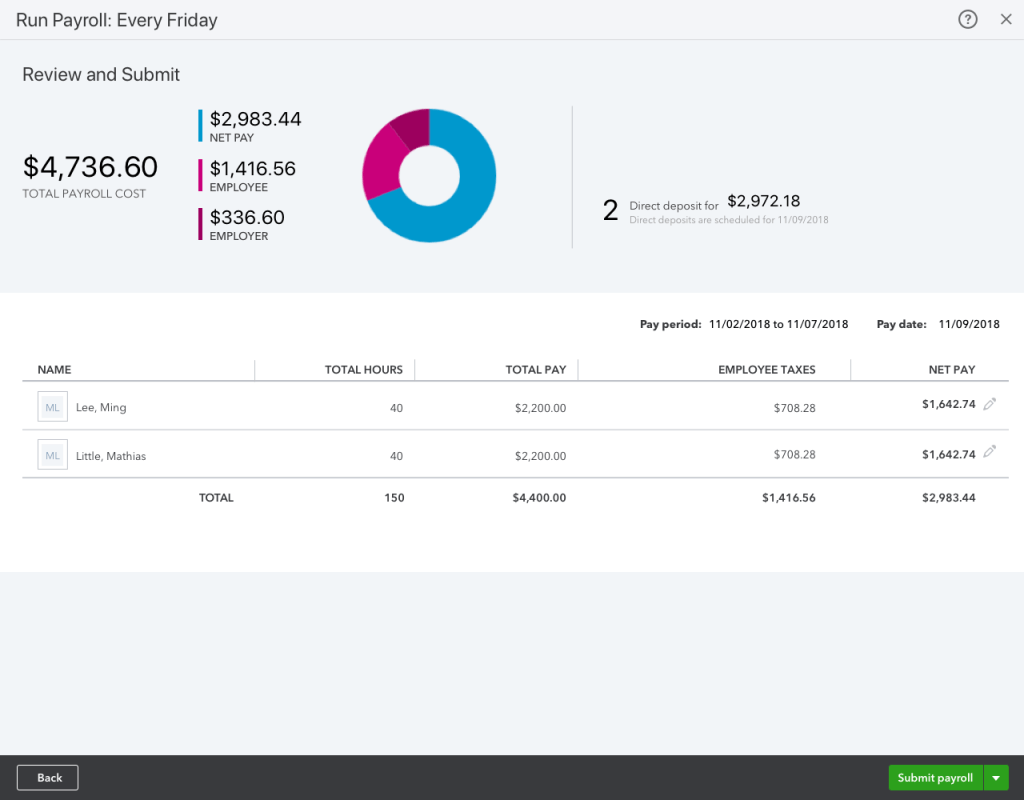

Run your Payroll & let us calculate all taxes

Now run your payroll together with QuickBooks and calculate payroll taxes right in QuickBooks as automatically.

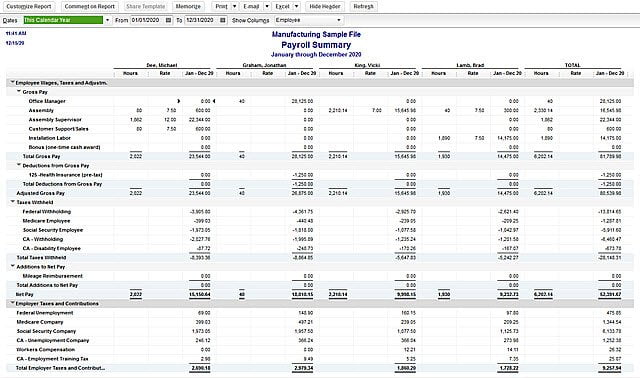

Payroll reports

Run all payroll reports in QuickBooks applications to get all info you need to keep things as safe and run in a smooth manner.

Direct Deposit

It is to pay all employees by a direct deposit for getting no extra ordinary cost.

File & Pay taxes

File and remit your payroll taxes with the help of CRA or Revenu Quebec.

Year & Forms

Prepare your accounts as yearly and updated all tax forms through payroll systematically till the end of the financial year summaries including employee forms like T4s and Relive 1s by online.

Records of an Employment

It’s too simple now to prepare file Records of Employment when an employee resigns or as leaves the firm.

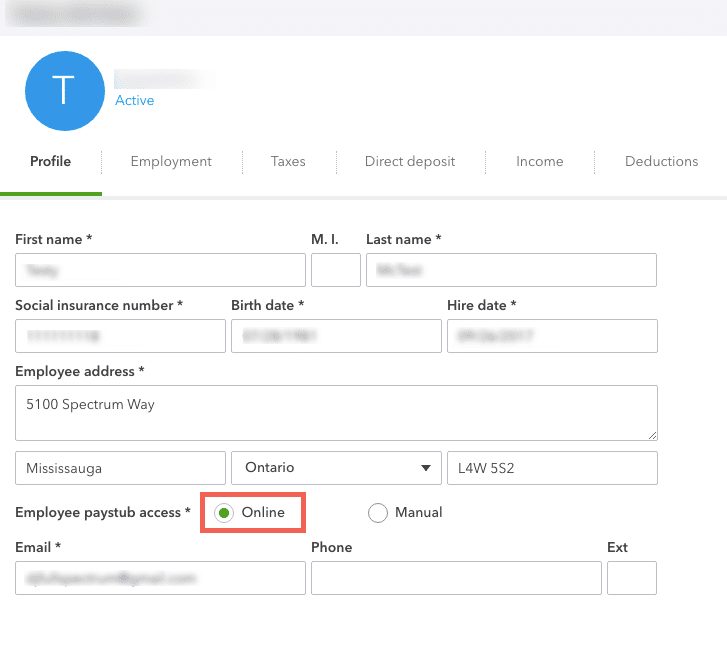

Employee Access

All employees can update their personal financial info as confidential and view their pay stubs and tax forms through online.

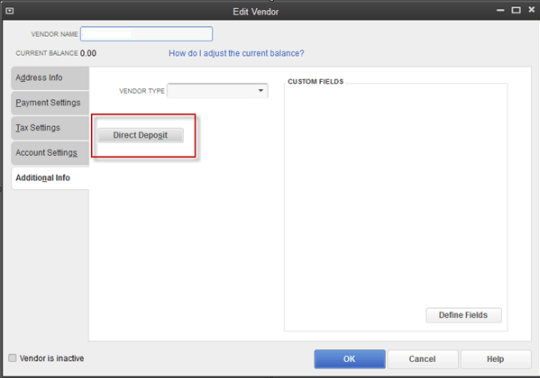

Pay Contractors

Pay contractors and automatically creates the file T4As at the end of a financial year.

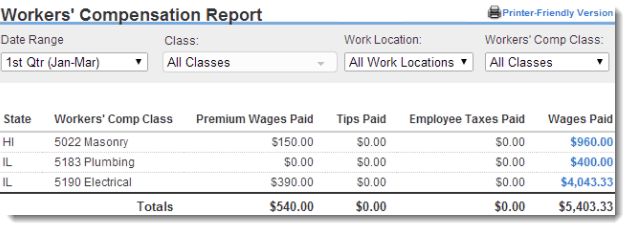

Workers Compensation

By using payroll together in any organization it calculates automatically, instantly tracks, and remits workers compensation pending dues or other deductions made for each worker in a company.

Connect with QuickBooks

Get to connect with QuickBooks to your bank account and this automatically match your income and further expense along with bank transactions from anywhere or at anytime.

Read this also: How to Resolve Email Issues in QuickBooks Desktop?

Final words..!

As QuickBooks Payroll is one of the most popular software that is used for all sized organizations either it’s small, medium or a large organization. If troubling somewhere then ask expert guidance by contacting to our expert QuickBooks Payroll customer support at +1-888-510-9198 avails for round the clock. Our technicians are highly trained and proficient in resolving innumerable pitfalls at the troubled-situation.

Feel free to ask your queries directly to our QuickBooks Experts where QB users will get a unique knowledge for Payroll version and can able to run their business more efficiently with QuickBooks together. This enhances the way to your business and made easy to calculate all company’s perks. We are available 24/7 hour of customer service.

FAQs Related to Intuit Payroll Services

For this:

1. You need to first head to taxes, and then payroll tax.

2. After that, choose payments.

3. Look for the overpaid tax and hit resolve.

4. If unable to fix the issue, reach out to our technical support team.

You can fix this using the steps below:

1. Choose the banking menu at first, and select use register.

2. After that, choose bank account, and hit ok tab.

3. You now have to, choose and open the check in question.

4. Once done with that, select paycheck detail

5. And update the paycheck as needed.

6. Now, hit ok tab

7. And choose save and close and hit yes.

Note that, you need an active QuickBooks desktop payroll subscription to update your tax table. In case you use QuickBooks online payroll, your tax tables are automatically updated.

Read more helpful article from here

How to do QuickBooks Payroll Setup Checklist?