Making an incorrect journal entry mistakenly is pretty common. In such a scenario, you might have to delete or reverse an entry by performing some basic steps. You can simply create journal entries in QuickBooks on your own, and if some issue arises, you can edit or correct a journal entry by reversing it if needed. Any entry made mistakenly can be removed permanently. A journal entry can be created and deleted in both QuickBooks desktop and QuickBooks online. However, the process might differ in both cases. To help you further, here we are with this segment sharing how to delete a journal entry in QuickBooks successfully.

In case you have any queries or if you need any sort of technical guidance at any point in time, then in that case, feel free to connect with our technical support professionals at +1-888-510-9198, and let them help you with your queries.

Also Read: How to Download Bank Feed transactions in QuickBooks Desktop?

Important points to consider

Before you directly jump on to the steps to reverse or delete journal entries, it is essential to understand the difference between the two.

- Reverse a journal entry: This can be done when you need to allocate a transaction between two accounting periods or fix a debit/credit error. Note that, reversing simply reverses the debits and credits and doesn’t delete the original entry.

- Delete a journal entry: In case you create it by mistake and need to get rid of the entry permanently.

How to delete a journal entry in QuickBooks Desktop?

The procedure to delete a journal entry in QuickBooks Desktop is different from QuickBooks Online. Let us understand the steps in detail:

- Initially, you need to head to the company menu.

- Now, choose make general journal entries.

- Once done with that, find and choose the journal entry that you want to delete:

- In QuickBooks for Windows, choose find and enter the name, date, entry no, or amount, and then choose find.

- In QuickBooks for Mac, choose the journal entry you wish to reverse from the list on Make general journal entries window.

- In order to delete the journal entry:

- You need to double-click the journal entry in QuickBooks for Windows and then choose delete, or void and click on the ok tab.

- In QuickBooks for Mac, you need to choose Delete General Journal from the edit menu.

- And the last step is to choose save and close.

You might find this helpful: How to Delete Duplicate Transactions in QuickBooks?

Steps to reverse a journal entry in QuickBooks Desktop

In order to reverse a journal entry in QuickBooks desktop, you need to carry out the following steps:

- At first, navigate to the company menu and choose Make general journal entries.

- After that, find and choose a journal entry that you want to reverse.

- In QuickBooks for Windows: You will have to choose find and enter the name, date, entry no, or amount and choose find.

- Whereas in QuickBooks for Mac, you simply have to find and select the journal entry you wish to reverse on the left side of the Make general journal entries window.

- Now, go for the reverse option.

- And lastly, choose save and close.

How to Delete a journal entry in QuickBooks Online?

Note that, deleting a wrong journal entry can unbalance the accounts immediately. Thus, you must be absolutely sure to delete the journal entry. In case you invited your accountant to review your books, then instead of deleting the entry, it is possible to make an adjusting journal entry. Having said that, let us check out the steps to delete a journal entry in QuickBooks Online.

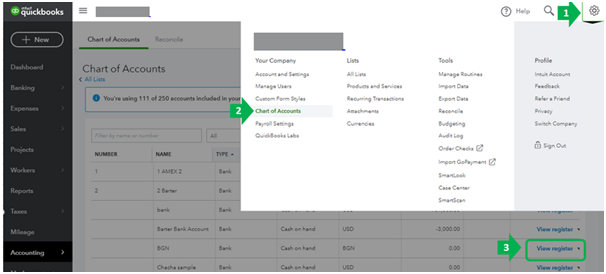

- To begin with, you simply need to choose the settings tab and then go for the chart of accounts.

- Once done with that, find the account you create the journal entry for.

- Now, choose the account history tab.

- And find the journal entry in the account register.

- The word journal should be present in the Ref no. or type column.

- The next step is to choose a journal entry to expand the view.

- Then, simply click on delete and yes to confirm.

- This would delete the entry successfully.

Steps to reverse a journal entry in QuickBooks Online

Reversing a journal entry usually reverses the debits and credits and doesn’t delete the original entry. The steps involved in reversing a journal entry in QuickBooks online are as follows:

- You need to first choose the settings tab and go for the chart of accounts in QuickBooks.

- Once done with that, find the account you created the journal entry for.

- Now, go for the account history.

- And find the journal entry in the account register.

- The word journal should be in the Ref no. or type column.

- The next step is to choose the journal entry to expand the view and click on the edit tab.

- Now, choose reverse and click on save to end the process.

When you reverse an entry in QuickBooks, the software creates a new journal entry to balance it. This is a record of the changes that you made.

The new journal entry in QuickBooks might show slightly different information.

- The reversed journal entry keeps the original journal no. and further adds the letter R indicating Reconciled.

- The new entry is dated the first day of the month following the original journal entry date.

- It further keeps the same info, such as account, name, and description as the original journal entry.

Also Read: Compile Error in Hidden Module – QuickBooks [FIX]

Conclusion!

Deleting or reversing a journal entry in QuickBooks desktop and online involves a handful of steps only. However, it is important to ensure that you actually need to delete or reverse the entry or not, as this might trigger balance issues. Hopefully, reading this segment might have helped you in successfully deleting or reversing journal entry in QuickBooks. However, if you have any queries at any point in time, then in that case, feel free to connect with our technical support team at +1-888-510-9198, and we will provide you with immediate support and assistance.

Other Related Articles:

Create Custom Email Templates in QuickBooks Desktop

How to merge accounts in QuickBooks?

Complete Guide to Write Off Bad Debts in QuickBooks Desktop and Online