Learn the best ways to resolve payroll setup error code format 00000 XXXXX

Randomly bumped into a payroll setup error and can’t find an ideal way to terminate it? Well, if that is the case, then this piece of writing will help you with this. One can receive an error code in the format 00000 XXXXX depending on the action in the Payroll and the version of the QuickBooks which is in use. The error can appear as “Error: QuickBooks Payroll Setup-Error Code: XXXXX XXXXX” or “Unrecoverable Error: Error Code: XXXXX XXXXX”. The code can range from 00000 00001 to 00000 99999. Such an error further restricts the completion of the payroll set up and may lead to further ancillary issues. These errors can be further caused when the name of a file in the vendor or employee center, or on the timesheet, includes a character or if there is duplicate entries for the employee’s name.

This piece of writing is going to share the complete details about fixing payroll set up error code format 00000 XXXXX in QuickBooks. However, if you need in-depth information about it or need any type of help, you can contact QuickBooks Payroll Support and talk to an Intuit certified ProAdvisor today. Give us a call at +1-888-510-9198 and our technically sound QuickBooks team will ensure to answer all your queries immediately.

Read Also: What are the steps to resolve QuickBooks error 6069?

Different types of payroll setup error or unrecoverable error

Usually errors in this format occur when a file name either on the Vendor list or on the Employee Centre, or on the timesheet has a special character in the name, or when a duplicate entry of an employee name is found.

The error codes are as:

- 00002 71328

- 00002 20123

- 00000 17002

- 00000 38049

- 00000 88579

- 00000 38772

- 00000 97340

- 00000 88703

- 00000 40370

Additional Error Codes are:

- 00000 99867

- 00000 88703

- 00000 34289

Read this also: How to Fix QuickBooks Error 6129, 0?

What causes QuickBooks Unrecoverable error 00000 XXXXX?

You can often experience such an error, if the any of the below factors appear:

- In case there is some special character present in the file name on the vendor list or the employee center.

- Also, if there are some special characters present in the filename of the timesheet.

- You can further come across such an error when any duplicate entry of an employee name is present.

Steps to Solve QuickBooks Error Unrecoverable Error

Performing the below enumerated procedures can help you in terminating the payroll setup error code successfully. Let us evaluate each of the methods one by one:

Method 1: When payroll setup error code 00000 XXXXX appears on the screen

Under this prcoedure, you are supposed to perform the following set of steps:

- When the error message appears on your display, click on the ‘View Report Link‘ option from the Error Window. Upon clicking a new window will appear with the partial view of failure details.

- Find and open file ‘ReportHeader.xml‘ in Internet Explorer by double clicking on the file name from the list of files in the window.

- In case the file doesn’t open, report location of the file ‘ReportHeader.xml‘.

- Use ‘Windows Explorer‘ to go to the location of the file ‘ReportHeader.xml‘ and open the file by right clicking on it and Open in ‘New Window‘ on Internet Explorer.

- Press ‘CTRL+F‘ keys to open the search box and then type ‘Exception String 0‘ in the upcoming search box.

- Note that the statement following the exception string 0 in the report provides details about the origin of the error. Head to the necessary changes to fix QB payroll setup error. For example: <Name>Exception String 0</Name> <Value>System.Exception: exception thrown in background thread —> System.ArgumentException: Item has already been added. Key in dictionary: ‘(unnamed employee)’ Key being added: ‘(unnamed employee)‘ at System.Collections.SortedList.Add(Object key, Object value)

Also Read: Fix QuickBooks Unrecoverable Error (General Troubleshooting)

Method 2: Fix the following error messages:

Error 1: When item has already been added. Key in dictionary: “[Vendor or payroll item name]” key being added

In case the exception string 0 statement displays that the item is already present, then perform the steps below:

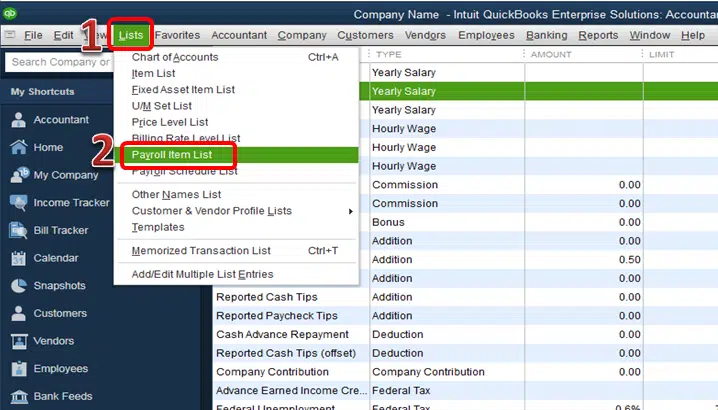

- The first step is to choose vendors from top menu bar and further select vendor center or choose items, then go for payroll item list.

- Spot the vendor causing the issue and the same vendor shall be enlisted twice.

- Furthermore, go for show inactives and this will show up potential duplicate items.

- Once done with that, rename one of them with a unique name.

Error 2: In case the item has already been added. Key in dictionary: unnamed employee being added

Just in case there exists a duplicate name of the employee, then remove it in the employee center. And perform the steps below:

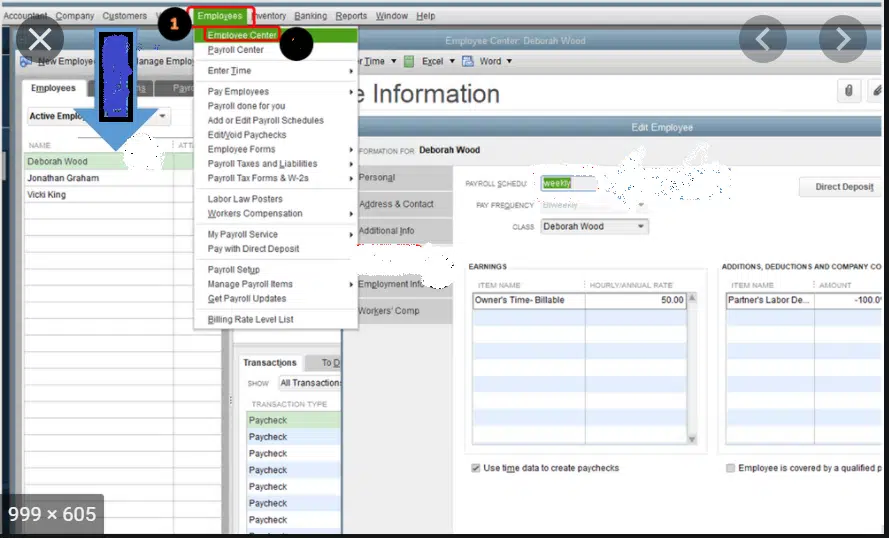

- You need to first navigate to the employees option from the top menu bar. Further head to the employee center.

- Once done with that, choose all employees from the list.

- And further right click the duplicate names and choose delete employee.

- In case you are unable to delete the duplicate employee due to current payroll transactions, then simply move the transactions to the primary employee listed.

- Also, try to delete the duplicate employee again. In case there is no payroll transaction on the account of an employee, then time card data might be damaged or corrupted. Head to employees and then entry time and look for entries that contain ODD or INVALID characters.

Error 3: Item has already been added. Key in dictionary: unnamed employee the specified special account already exists.

To fix this, continue with the steps below:

- Choose the employees option from the menu and further click on the employee center.

- You now have to choose all employees to include inactive employees from the view drop down.

- Once done with that inspect all the name setups and remove unwanted spaces.

- After that, enter the first and the last name in the fields manually.

Move to each profile of the employee to look over the employee’s first and last name field. Further delete any spaces that are blank before or following the employees’ first or last name. Also, enter a first name and last in the absence of them and they will only show up in the print on check as field.

Also Read: QuickBooks Tool Hub: Download & Install to Fix QuickBooks Errors

Error 4: The storage category map is invalid for local tax payroll item

If such an error message appears, then fix it by performing the steps below:

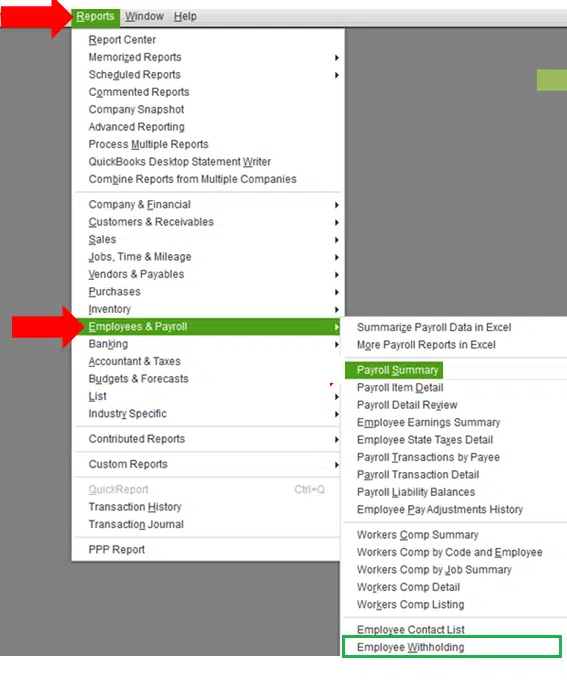

Step 1: Create an Employee Withholding report.

- First of all you need to click on Reports > Employees & Payroll > Employee Withholding

- After that click Customize Report.

- Under Columns remove the checkmarks from the current items and place a checkmark next to Employee, Local Tax 1, Local Tax 2, Local Tax 3, Local Tax 4, Local Tax 5, Local Tax 6, Local Tax 7, Local Tax 8, Local Tax 9, Local Tax 10, Local Tax 11, Local Tax 12.

- Now hit a click on the Filters tab.

- Click on Active Status and select All. Now click on OK.

- Leave the report open, print or click Excel > Create New Worksheet to export to Excel.

Step 2: Create a Payroll Item Listing report.

- Firstly, hit a click on Reports > Employees & Payroll > Payroll Item Listing.

- After that click Customize Report.

- Remove the checkmarks from all the items except Payroll Item and Type.

- Click Active Status and select All.

- Then Click the Filters tab.

- Click OK.

- Leave the report open, print or click Excel > Create New Worksheet to export to Excel.

Step 3: Compare the two reports. Look for Local Taxes that are not type Other.

Step 4: Edit each employee with a tax item that is not type Other

- You can double-click the employee from the Employee Withholding report to open the Edit Employee window.

- Click the Payroll Info tab

- Then click the Taxes button.

- From the Other tab remove the tax item that does not have a type Other.

- Click OK twice to save your changes

Step 5: Run Payroll Setup again

You might find this helpful: Got Unexpected Error 5 in Call to NetShareGetInfo for Path – Fix Now!

Error 5: System.IO.FileNotFoundException: Could not load file or assembly

In case the file inside QuickBooks has been damaged or missing, then try fixing it by repairing QuickBooks desktop. In case this doesn’t work, then perform a clean install of QuickBooks in selective startup.

Error 6: Value doesn’t fall within the expected range

This error generally occurs along with a code: QuickBooks payroll error 00000 99867. This means that the employee doesn’t have a state configuration in the profile. You can find the employee in the state missing, and then fix it. The steps involved here are:

- First, go for employees and then choose employee center

- After that, right click anywhere on the employee list and further choose customize column option.

- Moreover, on the available columns list, choose state lived and further click on b.

- In the available columns list, select the state worked column, and further select add.

- You now have to select ok tab.

- And also, double click on the employee who is not in state.

- Further, choose payroll information.

- And then, select taxes.

- Go for the state tab and select correct state.

See Also: What is QuickBooks desktop 2018?

Conclusion!

In case you are not able to solve the issue of the Payroll Setup Error Code 00000 XXXXX, then be sure to call the QuickBooks customer support number i.e. +1-888-510-9198 for speedy and well guided solutions instantly. You could speak with our representative at any time because we are always ready to help all QB users. Feel free to contact us and get instant solution & technical support for you concerns.

FAQs Related to Payroll setup error

To fix the payroll service server error, you can simply perform the steps below:

1. At first, restart the system.

2. And then, move to the command prompt and end DNS.

3. Delete the temporary internet files

4. After that, continue with the second step.

5. You now have to try to send the payroll and if it isn’t sent, then perform other related steps.

Unrecoverable error can be seen in case of network issues. Or if there are missing windows or QuickBooks updates. Any sort of issues with the data integrity with QB company file can further lead to such an error.

You can get an unrecoverable error in QuickBooks in case of missing windows or QuickBooks updates. Or if there are any sort of damage to the data.

Articles you may also like:

Steps to Upgrade QuickBooks Enterprise to Latest Version

How to Fix QuickBooks Unrecoverable Error?

Steps to Fix Error 12xxx when getting QuickBooks Payroll Updates

![Payroll Setup Error code format 00000 XXXXX [Unrecoverable Error]](https://www.hostdocket.com/wp-content/uploads/2020/03/Payroll-Setup-Error-code-format-00000-XXXXX-Unrecoverable-Error.jpg)