Have you ever heard of SUI rate for basic, enhanced, or standard payroll? Well, SUI tax rates stand for State unemployment insurance. It provides employees who lost their data for different reasons with a short-term benefit. Moreover, when you mistakenly put-up state taxes or payroll items. QuickBooks incorrectly deducts unemployment from an employee’s paycheck. You state sets your SUI rate. And this rate is unique to every business. In case you are a new employer, your state will assign you a new employer rate until you file unemployment taxes for a certain period of time. Often when SUI rate changes, you will have to update it in payroll. This surely keeps your SUI tax liability accurate. It should be noted that the state unemployment insurance is only paid by the employer, unless the state requires employees to contribute.

In addition to that QuickBooks 2013 for windows requires a valid Intuit payroll subscription with recent upgrades being installed. You can further configure QuickBooks to accurately compute unemployment as long as the employee hasn’t used up all of the state unemployment insurance benefits. To learn further about SUI and to explore the process to change SUI, make sure to stick around this piece of writing carefully. Or you can further connect with our tech support team in case of any queries. Feel free to reach out to us at +1-888-510-9198, and we will answer all your queries immediately.

Facts Related to SUI Tax

- These SUI rates are important for your large business and that is issues by a state.

- SUI tax rate is not a part of payable tax & it is critical that a user enter their tax rate in their QB desktop software.

- This tax is paid by the employer until and unless your state and employees contribute with each other.

- SUI wage limit will be rationalized through the tax table as per rules according to which state you belong to. Remember one thing, this will not be modified by a manual.

- In the beginning of a financial year, many states will already update SUI tax rate. In fact, others such as New Jersey, Vermont and Tennessee will update their SUI tax rate in the first quarter of a financial year.

Also Read: QuickBooks Payroll Setup Checklist: Intuit Desktop Payroll & QuickBooks Online Payroll

Run QuickBooks Payroll with an Ease & Accuracy

QuickBooks Payroll software is used to manage your accounting in a well-planned way. With the help of this payroll, this brings our work less stress and reduces the workload by consuming less time. If you have any queries, then ask expert advice directly from our QuickBooks Consulting Service team.

Method that Describes SUI basic, Enhanced or Standard Payroll

Know what the facts about SUI tax rate are

- All rates are exclusively unique for every new business & this can be issued by any state.

- The rate is also not a part of an updated tax table. It’s critical that you enter the current rate in your QuickBooks Desktop.

- If it is paid by an employer, it is unless that you’re in a state or want to contribute by the employees.

Read Also: What is the Best Ways to Fix QuickBooks Error QBW32.exe?

Steps to Change the SUI tax rates in Enhanced or Standard Payroll

Now we need to understand that points to change SUI tax rate in Enhanced Payroll & Standard payroll

- First of all, choose an option of Lists. Then click to the Payroll item list.

- After that, double-click on the SUI tax item, which is typically named: [state abbreviation] – unemployment company.

- Then click on the next key button. Click on the company tax rates as yearly.

- An account is also required to type correct rates as per quarterly.

Note: Remember one thing that if your device date is 7/1 & 1/1 that a user will now able to include the rate for a first quarter as for annually.

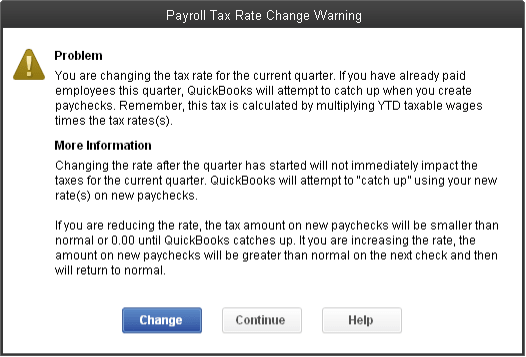

- While to do so if you mention all correct rates or a user get an error message as Payroll Tax Rate Change Warning on your desktop screen. Now click the continue option. Thus, the user SUI rates will now be updated.

- Now click on the next option and then give a one clicks to clear of all unnecessary items which are having no matter related to SUI tax.

- After this, give a click to the next option and then click on the finish button, if troubling somewhere then asks expert guidance provided by QuickBooks Payroll Support team.

- If you want to change or require you to make some modifications in Sui wage bases or sums that are reports to our workers. Set up a payroll report and standardized these numbers.

Also Read: How to Resolve Unrecoverable Error in QuickBooks Desktop?

Few Important Tips

Here are some tips describing as that boost to change SUI tax rates and enhanced or standard payrolls as explained here: –

- Firstly, select or click as reports & then click to an employees and payroll option.

- After that, set the date to keep track as quarterly.

- Now click to customize the accounting report and select the following details.

- Date required for proper information.

- Want the Source Name for that report.

- Which Payroll Item you’re using.

- Wage Bases of a payroll.

- Total amount mentioned in the given payroll.

- While to do so, click the filters option, in the above list, select the payroll items.

- Now give one single click to the payroll item. Select the State unemployment item.

- Now let us look at the total wages that are based upon the column and can increase the present rate.

- At the end, users need to match all sums that you have calculated.

Hopefully, this article helped you to understand about SUI Tax Rates & how to change in basic, enhanced or standard payroll, if troubling somewhere or have any query then feel free to contact us at our QuickBooks support number through given toll-free number +1-888-510-9198. Thanks for visiting our page, if you want any additional services our Certified ProAdvisors team is available to help you with all accounting and bookkeeping solutions.

You may also like: How to Fix QuickBooks Error Code H505?

Get Instant help

If you are facing errors while operating or accessing your payroll account? Then you’re at the right place where end users will get instant solutions provided by our Intuit certified Pro Advisors. No more wait, give us a call on our toll-free number +1-888-510-9198, and share your problems with our experienced professionals who have years of experience sorting out all accounting and quick booking solutions. Thus, our accessibility is round the clock. It’s too easy to connect our experts that are more qualified and highly knowledgeable in resolving all sorts of hindrances in real-time.

FAQs Related to SUI Rate in QuickBooks

To alter tax rates in QuickBooks, you can perform the below steps:

1. Open QuickBooks company page and choose reports from the menu

2. Choose item list

3. Every item that is stored in QuickBooks will be visible

4. Locate customize report in the top menu bar and click on the same

5. Press filter tab

6. Choose account after that, and select all liabilities from the drop-down box.

7. The sales tax list should be printer

8. Click on print and choose report from the list

9. When a new window appears, select your printer and press print tab

You can change the payroll settings in QuickBooks using the steps below:

1. Open QuickBooks desktop company file and sign in as QuickBooks admin

2. Choose edit, and go for preferences.

3. From menu choose payroll and employees

4. Go for preferences tab

5. Ensure that QuickBooks payroll features is set to full payroll

State unemployment insurance is a tax funded program by employers to give short term benefits to workers who have lost their job. This tax is needed by state and federal law. Unemployed workers receive these benefits on the condition that they are looking for new job.

Read Also

How to Fix QuickBooks Error Code 6123, 0?

How to Fix QuickBooks Error Code 6189 and 816?

Learn How To Create And Restore A QuickBooks Portable Company File